2016

Exibindo questões de 201 a 300.

Uma pedra de gelo, de 1,0 kg de massa, é retirada de um - FGV 2016

Física - 2016Uma pedra de gelo, de 1,0 kg de massa, é retirada de um ambiente em que se encontrava em equilíbrio térmico a –100°C e recebe 150 kcal de uma fonte de calor. Considerando o calor específico do gelo 0,5 cal/(g.°C), o da água 1,0 cal/(g.°C), e o calor latente de fusão do gelo 80 cal/g,

Em uma das oscilações, Mariana partiu do extremo, de uma - FGV 2016

Física - 2016Em uma das oscilações, Mariana partiu do extremo, de uma altura de 80 cm acima do solo e, ao atingir a posição inferior da trajetória, chutou uma bola, de 0,5 kg de massa, que estava parada no solo. A bola adquiriu a velocidade de 24 m/s imediatamente após o chute, na direção horizontal do solo e do movimento da menina. O deslocamento de Mariana, do ponto extremo até o ponto inferior da trajetória, foi realizado sem dissipação de energia mecânica.

Para determinados tipos de pesquisa ou trabalho, cápsulas - FGV 2016

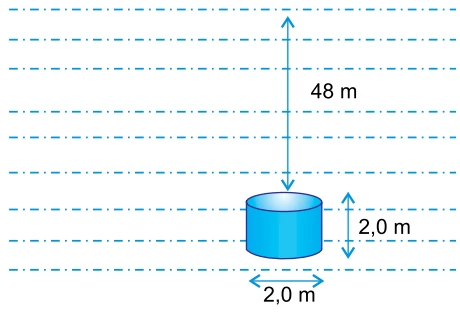

Física - 2016Para determinados tipos de pesquisa ou trabalho, cápsulas tripuladas são enviadas para as profundezas dos oceanos, mares ou lagos. Considere uma dessas cápsulas de forma cilíndrica, de 2,0 m de altura por 2,0 m de diâmetro, com sua base superior a 48 m de profundidade em água de densidade 1,0.103 kg/m3 , em equilíbrio como ilustra a figura.

Dados:A pressão atmosférica no local é de 1,0.105 Pa, e a aceleração da gravidade é de 10 m/s2. Adote π = 3.

Nesse parquinho infantil, há dois escorregadores de mesma - FGV 2016

Física - 2016O texto a seguir refere-se à questão

Criança feliz é aquela que brinca, fato mais do que comprovado na realidade do dia a dia. A brincadeira ativa, a que faz gastar energia, que traz emoção, traz também felicidade. Mariana é uma criança que foi levada por seus pais para se divertir em um parquinho infantil.

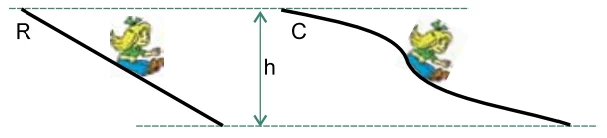

Nesse parquinho infantil, há dois escorregadores de mesma altura h relativamente ao chão. Um deles é retilíneo (R) e outro é curvilíneo (C) em forma de tobogã, como indica a figura.

A nave americana New Horizons passou, recentemente, bem - FGV 2016

Física - 2016O texto a seguir refere-se à questão

Criança feliz é aquela que brinca, fato mais do que comprovado na realidade do dia a dia. A brincadeira ativa, a que faz gastar energia, que traz emoção, traz também felicidade. Mariana é uma criança que foi levada por seus pais para se divertir em um parquinho infantil.

Inicialmente, Mariana foi se divertir no balanço. Solta, do - FGV 2016

Física - 2016O texto a seguir refere-se à questão

Criança feliz é aquela que brinca, fato mais do que comprovado na realidade do dia a dia. A brincadeira ativa, a que faz gastar energia, que traz emoção, traz também felicidade. Mariana é uma criança que foi levada por seus pais para se divertir em um parquinho infantil.

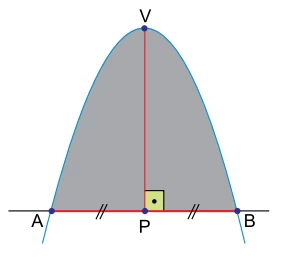

Inicialmente, Mariana foi se divertir no balanço. Solta, do repouso, de uma certa altura, ela oscilou entre dois extremos elevados, a partir dos quais iniciou o retorno até o extremo oposto. Imagine-a no extremo da direita como na figura.

Não está longe a época em que aviões poderão voar a - FGV 2016

Física - 2016Não está longe a época em que aviões poderão voar a velocidades da ordem de grandeza da velocidade da luz (c) no vácuo.

A figura mostra o painel de instrumentos de um automóvel em - FGV 2016

Física - 2016A figura mostra o painel de instrumentos de um automóvel em movimento. Os maiores medidores são: à esquerda, o tacômetro (conta-giros do motor), e à direita, o velocímetro.

Um veículo desloca-se por uma pista horizontal, retilínea - FGV 2016

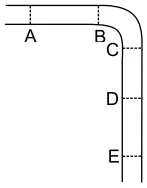

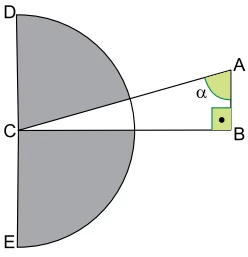

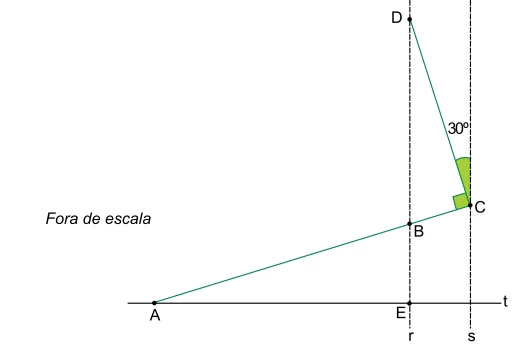

Física - 2016Um veículo desloca-se por uma pista horizontal, retilínea nos trechos AB, CD e DE, e curvilínea no trecho BC, este em forma de quarto de circunferência, como ilustra a figura.

The last paragraph leads the reader to conclude that a) if - FGV 2016

Inglês - 2016Read the text and answer the question

China has created a monster it can’t control

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false” rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes”. Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting” with regulators, and hasn’t been heard of since. Her Chinese husband says “she’s gone on holiday”. We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn’t do what the high command wants it to.” When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn’t noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just” 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor’s and Fitch Rating with market abuse for daring to downgrade Italy’s credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing” other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market”, it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China’s stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China’s factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country’s burgeoning output of graduates. China’s modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country’s shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can’t do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

According to the tenth paragraph, a) internal demand in - FGV 2016

Inglês - 2016Read the text and answer the question

China has created a monster it can’t control

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false” rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes”. Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting” with regulators, and hasn’t been heard of since. Her Chinese husband says “she’s gone on holiday”. We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn’t do what the high command wants it to.” When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn’t noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just” 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor’s and Fitch Rating with market abuse for daring to downgrade Italy’s credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing” other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market”, it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China’s stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China’s factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country’s burgeoning output of graduates. China’s modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country’s shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can’t do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

In relation to the job market, the eight and ninth - FGV 2016

Inglês - 2016Read the text and answer the question

China has created a monster it can’t control

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false” rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes”. Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting” with regulators, and hasn’t been heard of since. Her Chinese husband says “she’s gone on holiday”. We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn’t do what the high command wants it to.” When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn’t noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just” 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor’s and Fitch Rating with market abuse for daring to downgrade Italy’s credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing” other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market”, it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China’s stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China’s factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country’s burgeoning output of graduates. China’s modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country’s shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can’t do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

The seventh paragraph begins with the statement – As recen - FGV 2016

Inglês - 2016Read the text and answer the question

China has created a monster it can’t control

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false” rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes”. Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting” with regulators, and hasn’t been heard of since. Her Chinese husband says “she’s gone on holiday”. We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn’t do what the high command wants it to.” When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn’t noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just” 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor’s and Fitch Rating with market abuse for daring to downgrade Italy’s credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing” other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market”, it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China’s stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China’s factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country’s burgeoning output of graduates. China’s modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country’s shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can’t do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

In the excerpt from the sixth paragraph – European official - FGV 2016

Inglês - 2016Read the text and answer the question

China has created a monster it can’t control

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false” rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes”. Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting” with regulators, and hasn’t been heard of since. Her Chinese husband says “she’s gone on holiday”. We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn’t do what the high command wants it to.” When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn’t noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just” 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor’s and Fitch Rating with market abuse for daring to downgrade Italy’s credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing” other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market”, it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China’s stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China’s factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country’s burgeoning output of graduates. China’s modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country’s shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can’t do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

The fifth and sixth paragraphs together show that (A) - FGV 2016

Inglês - 2016Read the text and answer the question

China has created a monster it can’t control

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false” rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes”. Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting” with regulators, and hasn’t been heard of since. Her Chinese husband says “she’s gone on holiday”. We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn’t do what the high command wants it to.” When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn’t noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just” 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor’s and Fitch Rating with market abuse for daring to downgrade Italy’s credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing” other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market”, it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China’s stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China’s factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country’s burgeoning output of graduates. China’s modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country’s shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can’t do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

In the last sentence of the fourth paragraph, the excerpt - FGV 2016

Inglês - 2016Read the text and answer the question

China has created a monster it can’t control

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false” rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes”. Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting” with regulators, and hasn’t been heard of since. Her Chinese husband says “she’s gone on holiday”. We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn’t do what the high command wants it to.” When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn’t noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just” 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor’s and Fitch Rating with market abuse for daring to downgrade Italy’s credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing” other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market”, it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China’s stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China’s factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country’s burgeoning output of graduates. China’s modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country’s shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can’t do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

The fourth paragraph shows that the Chinese administration - FGV 2016

Inglês - 2016Read the text and answer the question

China has created a monster it can’t control

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false” rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes”. Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting” with regulators, and hasn’t been heard of since. Her Chinese husband says “she’s gone on holiday”. We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn’t do what the high command wants it to.” When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn’t noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just” 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor’s and Fitch Rating with market abuse for daring to downgrade Italy’s credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing” other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market”, it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China’s stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China’s factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country’s burgeoning output of graduates. China’s modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country’s shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can’t do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

The third paragraph points out to the fact that the Chinese - FGV 2016

Inglês - 2016Read the text and answer the question

China has created a monster it can’t control

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false” rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes”. Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting” with regulators, and hasn’t been heard of since. Her Chinese husband says “she’s gone on holiday”. We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn’t do what the high command wants it to.” When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn’t noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just” 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor’s and Fitch Rating with market abuse for daring to downgrade Italy’s credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing” other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market”, it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China’s stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China’s factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country’s burgeoning output of graduates. China’s modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country’s shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can’t do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

The information contained in the first two paragraphs impli - FGV 2016

Inglês - 2016Read the text and answer the question

China has created a monster it can’t control

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false” rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes”. Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting” with regulators, and hasn’t been heard of since. Her Chinese husband says “she’s gone on holiday”. We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn’t do what the high command wants it to.” When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn’t noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just” 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor’s and Fitch Rating with market abuse for daring to downgrade Italy’s credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing” other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market”, it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China’s stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China’s factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country’s burgeoning output of graduates. China’s modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country’s shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can’t do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

Two years before the article was written, sales in real - FGV 2016

Inglês - 2016Read the text and answer the question

A Housing Meltdown Looms in Brazil as Builders Seek Debt Relief

by Julia Leite and Paula Sambo

August 26, 2015

Not long ago, Brazil’s real-estate market was one of the biggest symbols of the country’s burgeoning economic might. Now, it’s fallen victim to an ever-deepening recession. PDG Realty SA, once the largest homebuilder by revenue, hired Rothschild last week to help restructure 5.8 billion reais ($1.6 billion) of debt after second-quarter net sales sank 88 percent. Earlier this month, Rossi Residencial SA, which has 2.5 billion reais in debt, also brought in advisers to “restructure operations and review strategies.” Since 2010, the builder has lost 99 percent of its stock-market value.

The real-estate industry, which is equal to about 10 percent of Brazil’s economy, is emerging as one of the latest casualties of a recession that analysts forecast will be its longest since the 1930s. To make matters worse, interest rates are the highest in almost a decade while inflation is soaring. “There is no real estate company that survives without sales,” Bruno Mendonça Lima de Carvalho, the head of fixed income at Guide Investimentos SA, said from Sao Paulo. “You can’t import or export apartments. You’re relying solely on domestic activity.”

PDG tried to boost revenue by lowering prices, financing up to 20 percent of some home purchases and even offering to buy back apartments if banks deny financing. Still, it sold just 217 units in the second quarter on a net basis, compared with 1,749 in 2014.

Negative Outlook

On Friday, Moody’s Investors Service cut PDG’s rating three levels to Caa3, citing the possibility of significant losses for bondholders and other lenders. Secured creditors may recover less than 80 percent in a default, according to Moody’s, which kept a negative outlook on the rating. “The company is facing additional liquidity pressures from a prolonged deterioration in industry dynamics, including weak sales speed, tight financing availability and declining real estate prices,” Moody’s said.

Sao Paulo-based Rossi said in an e-mailed response to questions that second quarter sales improved and that the company’s main focus is to reduce debt. Gross debt fell about 30 percent in the 12 months ended in June, Rossi said.

Home sales in Latin America’s biggest economy tumbled 14 percent in the first half of 2015, according to data from the national real estate institute. Builders cut new projects by 20 percent during that span, while available financing shrank by about a quarter

Real’s Collapse

That’s a reversal from just two years ago, when realestate prices in places like Rio de Janeiro and Sao Paulo had surged as much as 230 percent as rising incomes, a soaring real and record-low borrowing costs ignited a wave of home buying.

Brazilians find themselves in drastically different circumstances today. The currency fell 0.4 percent Wednesday as of 3:25 p.m. in New York, extending its loss this year to 26 percent. The jobless rate climbed to a five-year high of 7.5 percent last month.

The central bank boosted its key rate to 14.25 percent in July, making it ever more expensive to finance the purchase of a home. “It’s a matter of demand, and demand is really weak,” Will Landers, who manages Latin American stocks at BlackRock, said from Princeton, New Jersey. “We may have reached a peak in interest rates, but they should continue to be at these levels for a while. Consumers will stay on the sidelines because debt levels are still high, and employment will get worse.”

(Business Week at www.bloomberg.com/news. Adapted)

Rossi, one of the real-estate businesses mentioned in the a - FGV 2016

Inglês - 2016Read the text and answer the question

A Housing Meltdown Looms in Brazil as Builders Seek Debt Relief

by Julia Leite and Paula Sambo

August 26, 2015

Not long ago, Brazil’s real-estate market was one of the biggest symbols of the country’s burgeoning economic might. Now, it’s fallen victim to an ever-deepening recession. PDG Realty SA, once the largest homebuilder by revenue, hired Rothschild last week to help restructure 5.8 billion reais ($1.6 billion) of debt after second-quarter net sales sank 88 percent. Earlier this month, Rossi Residencial SA, which has 2.5 billion reais in debt, also brought in advisers to “restructure operations and review strategies.” Since 2010, the builder has lost 99 percent of its stock-market value.

The real-estate industry, which is equal to about 10 percent of Brazil’s economy, is emerging as one of the latest casualties of a recession that analysts forecast will be its longest since the 1930s. To make matters worse, interest rates are the highest in almost a decade while inflation is soaring. “There is no real estate company that survives without sales,” Bruno Mendonça Lima de Carvalho, the head of fixed income at Guide Investimentos SA, said from Sao Paulo. “You can’t import or export apartments. You’re relying solely on domestic activity.”

PDG tried to boost revenue by lowering prices, financing up to 20 percent of some home purchases and even offering to buy back apartments if banks deny financing. Still, it sold just 217 units in the second quarter on a net basis, compared with 1,749 in 2014.

Negative Outlook

On Friday, Moody’s Investors Service cut PDG’s rating three levels to Caa3, citing the possibility of significant losses for bondholders and other lenders. Secured creditors may recover less than 80 percent in a default, according to Moody’s, which kept a negative outlook on the rating. “The company is facing additional liquidity pressures from a prolonged deterioration in industry dynamics, including weak sales speed, tight financing availability and declining real estate prices,” Moody’s said.

Sao Paulo-based Rossi said in an e-mailed response to questions that second quarter sales improved and that the company’s main focus is to reduce debt. Gross debt fell about 30 percent in the 12 months ended in June, Rossi said.

Home sales in Latin America’s biggest economy tumbled 14 percent in the first half of 2015, according to data from the national real estate institute. Builders cut new projects by 20 percent during that span, while available financing shrank by about a quarter

Real’s Collapse

That’s a reversal from just two years ago, when realestate prices in places like Rio de Janeiro and Sao Paulo had surged as much as 230 percent as rising incomes, a soaring real and record-low borrowing costs ignited a wave of home buying.

Brazilians find themselves in drastically different circumstances today. The currency fell 0.4 percent Wednesday as of 3:25 p.m. in New York, extending its loss this year to 26 percent. The jobless rate climbed to a five-year high of 7.5 percent last month.

The central bank boosted its key rate to 14.25 percent in July, making it ever more expensive to finance the purchase of a home. “It’s a matter of demand, and demand is really weak,” Will Landers, who manages Latin American stocks at BlackRock, said from Princeton, New Jersey. “We may have reached a peak in interest rates, but they should continue to be at these levels for a while. Consumers will stay on the sidelines because debt levels are still high, and employment will get worse.”

(Business Week at www.bloomberg.com/news. Adapted)

The evaluation of the real-estate company by Moody’s, as - FGV 2016

Geografia - 2016Read the text and answer the question

A Housing Meltdown Looms in Brazil as Builders Seek Debt Relief

by Julia Leite and Paula Sambo

August 26, 2015

Not long ago, Brazil’s real-estate market was one of the biggest symbols of the country’s burgeoning economic might. Now, it’s fallen victim to an ever-deepening recession. PDG Realty SA, once the largest homebuilder by revenue, hired Rothschild last week to help restructure 5.8 billion reais ($1.6 billion) of debt after second-quarter net sales sank 88 percent. Earlier this month, Rossi Residencial SA, which has 2.5 billion reais in debt, also brought in advisers to “restructure operations and review strategies.” Since 2010, the builder has lost 99 percent of its stock-market value.

The real-estate industry, which is equal to about 10 percent of Brazil’s economy, is emerging as one of the latest casualties of a recession that analysts forecast will be its longest since the 1930s. To make matters worse, interest rates are the highest in almost a decade while inflation is soaring. “There is no real estate company that survives without sales,” Bruno Mendonça Lima de Carvalho, the head of fixed income at Guide Investimentos SA, said from Sao Paulo. “You can’t import or export apartments. You’re relying solely on domestic activity.”

PDG tried to boost revenue by lowering prices, financing up to 20 percent of some home purchases and even offering to buy back apartments if banks deny financing. Still, it sold just 217 units in the second quarter on a net basis, compared with 1,749 in 2014.

Negative Outlook

On Friday, Moody’s Investors Service cut PDG’s rating three levels to Caa3, citing the possibility of significant losses for bondholders and other lenders. Secured creditors may recover less than 80 percent in a default, according to Moody’s, which kept a negative outlook on the rating. “The company is facing additional liquidity pressures from a prolonged deterioration in industry dynamics, including weak sales speed, tight financing availability and declining real estate prices,” Moody’s said.

Sao Paulo-based Rossi said in an e-mailed response to questions that second quarter sales improved and that the company’s main focus is to reduce debt. Gross debt fell about 30 percent in the 12 months ended in June, Rossi said.

Home sales in Latin America’s biggest economy tumbled 14 percent in the first half of 2015, according to data from the national real estate institute. Builders cut new projects by 20 percent during that span, while available financing shrank by about a quarter

Real’s Collapse

That’s a reversal from just two years ago, when realestate prices in places like Rio de Janeiro and Sao Paulo had surged as much as 230 percent as rising incomes, a soaring real and record-low borrowing costs ignited a wave of home buying.

Brazilians find themselves in drastically different circumstances today. The currency fell 0.4 percent Wednesday as of 3:25 p.m. in New York, extending its loss this year to 26 percent. The jobless rate climbed to a five-year high of 7.5 percent last month.

The central bank boosted its key rate to 14.25 percent in July, making it ever more expensive to finance the purchase of a home. “It’s a matter of demand, and demand is really weak,” Will Landers, who manages Latin American stocks at BlackRock, said from Princeton, New Jersey. “We may have reached a peak in interest rates, but they should continue to be at these levels for a while. Consumers will stay on the sidelines because debt levels are still high, and employment will get worse.”

(Business Week at www.bloomberg.com/news. Adapted)

The third paragraph implies that (A) with the high interest - FGV 2016

Inglês - 2016Read the text and answer the question

A Housing Meltdown Looms in Brazil as Builders Seek Debt Relief

by Julia Leite and Paula Sambo

August 26, 2015

Not long ago, Brazil’s real-estate market was one of the biggest symbols of the country’s burgeoning economic might. Now, it’s fallen victim to an ever-deepening recession. PDG Realty SA, once the largest homebuilder by revenue, hired Rothschild last week to help restructure 5.8 billion reais ($1.6 billion) of debt after second-quarter net sales sank 88 percent. Earlier this month, Rossi Residencial SA, which has 2.5 billion reais in debt, also brought in advisers to “restructure operations and review strategies.” Since 2010, the builder has lost 99 percent of its stock-market value.

The real-estate industry, which is equal to about 10 percent of Brazil’s economy, is emerging as one of the latest casualties of a recession that analysts forecast will be its longest since the 1930s. To make matters worse, interest rates are the highest in almost a decade while inflation is soaring. “There is no real estate company that survives without sales,” Bruno Mendonça Lima de Carvalho, the head of fixed income at Guide Investimentos SA, said from Sao Paulo. “You can’t import or export apartments. You’re relying solely on domestic activity.”

PDG tried to boost revenue by lowering prices, financing up to 20 percent of some home purchases and even offering to buy back apartments if banks deny financing. Still, it sold just 217 units in the second quarter on a net basis, compared with 1,749 in 2014.

Negative Outlook

On Friday, Moody’s Investors Service cut PDG’s rating three levels to Caa3, citing the possibility of significant losses for bondholders and other lenders. Secured creditors may recover less than 80 percent in a default, according to Moody’s, which kept a negative outlook on the rating. “The company is facing additional liquidity pressures from a prolonged deterioration in industry dynamics, including weak sales speed, tight financing availability and declining real estate prices,” Moody’s said.

Sao Paulo-based Rossi said in an e-mailed response to questions that second quarter sales improved and that the company’s main focus is to reduce debt. Gross debt fell about 30 percent in the 12 months ended in June, Rossi said.

Home sales in Latin America’s biggest economy tumbled 14 percent in the first half of 2015, according to data from the national real estate institute. Builders cut new projects by 20 percent during that span, while available financing shrank by about a quarter

Real’s Collapse

That’s a reversal from just two years ago, when realestate prices in places like Rio de Janeiro and Sao Paulo had surged as much as 230 percent as rising incomes, a soaring real and record-low borrowing costs ignited a wave of home buying.

Brazilians find themselves in drastically different circumstances today. The currency fell 0.4 percent Wednesday as of 3:25 p.m. in New York, extending its loss this year to 26 percent. The jobless rate climbed to a five-year high of 7.5 percent last month.

The central bank boosted its key rate to 14.25 percent in July, making it ever more expensive to finance the purchase of a home. “It’s a matter of demand, and demand is really weak,” Will Landers, who manages Latin American stocks at BlackRock, said from Princeton, New Jersey. “We may have reached a peak in interest rates, but they should continue to be at these levels for a while. Consumers will stay on the sidelines because debt levels are still high, and employment will get worse.”

(Business Week at www.bloomberg.com/news. Adapted)

According to the block comprising the first four paragraphs - FGV 2016

Inglês - 2016Read the text and answer the question

A Housing Meltdown Looms in Brazil as Builders Seek Debt Relief

by Julia Leite and Paula Sambo

August 26, 2015

Not long ago, Brazil’s real-estate market was one of the biggest symbols of the country’s burgeoning economic might. Now, it’s fallen victim to an ever-deepening recession. PDG Realty SA, once the largest homebuilder by revenue, hired Rothschild last week to help restructure 5.8 billion reais ($1.6 billion) of debt after second-quarter net sales sank 88 percent. Earlier this month, Rossi Residencial SA, which has 2.5 billion reais in debt, also brought in advisers to “restructure operations and review strategies.” Since 2010, the builder has lost 99 percent of its stock-market value.

The real-estate industry, which is equal to about 10 percent of Brazil’s economy, is emerging as one of the latest casualties of a recession that analysts forecast will be its longest since the 1930s. To make matters worse, interest rates are the highest in almost a decade while inflation is soaring. “There is no real estate company that survives without sales,” Bruno Mendonça Lima de Carvalho, the head of fixed income at Guide Investimentos SA, said from Sao Paulo. “You can’t import or export apartments. You’re relying solely on domestic activity.”

PDG tried to boost revenue by lowering prices, financing up to 20 percent of some home purchases and even offering to buy back apartments if banks deny financing. Still, it sold just 217 units in the second quarter on a net basis, compared with 1,749 in 2014.

Negative Outlook

On Friday, Moody’s Investors Service cut PDG’s rating three levels to Caa3, citing the possibility of significant losses for bondholders and other lenders. Secured creditors may recover less than 80 percent in a default, according to Moody’s, which kept a negative outlook on the rating. “The company is facing additional liquidity pressures from a prolonged deterioration in industry dynamics, including weak sales speed, tight financing availability and declining real estate prices,” Moody’s said.

Sao Paulo-based Rossi said in an e-mailed response to questions that second quarter sales improved and that the company’s main focus is to reduce debt. Gross debt fell about 30 percent in the 12 months ended in June, Rossi said.

Home sales in Latin America’s biggest economy tumbled 14 percent in the first half of 2015, according to data from the national real estate institute. Builders cut new projects by 20 percent during that span, while available financing shrank by about a quarter

Real’s Collapse

That’s a reversal from just two years ago, when realestate prices in places like Rio de Janeiro and Sao Paulo had surged as much as 230 percent as rising incomes, a soaring real and record-low borrowing costs ignited a wave of home buying.

Brazilians find themselves in drastically different circumstances today. The currency fell 0.4 percent Wednesday as of 3:25 p.m. in New York, extending its loss this year to 26 percent. The jobless rate climbed to a five-year high of 7.5 percent last month.

The central bank boosted its key rate to 14.25 percent in July, making it ever more expensive to finance the purchase of a home. “It’s a matter of demand, and demand is really weak,” Will Landers, who manages Latin American stocks at BlackRock, said from Princeton, New Jersey. “We may have reached a peak in interest rates, but they should continue to be at these levels for a while. Consumers will stay on the sidelines because debt levels are still high, and employment will get worse.”

(Business Week at www.bloomberg.com/news. Adapted)

Em fins de abril de 2015, o vulcão Calbuco, localizado no - FGV 2016

Geografia - 2016Em fins de abril de 2015, o vulcão Calbuco, localizado no Chile, 1000 km ao sul de Santiago, produziu uma gigantesca quantidade de cinzas que atingiu Buenos Aires (provocando o fechamento dos aeroportos da cidade), Montevidéu e até mesmo Porto Alegre, no Rio Grande do Sul.

O país passa por uma grave crise econômica caracterizada - FGV 2016

Geografia - 2016O país passa por uma grave crise econômica caracterizada por uma inflação galopante, câmbio descontrolado e sérios problemas de desabastecimento de bens e produtos básicos.

As filas passaram a fazer parte do cotidiano do país. Falta de leite a farinha de milho – base da receita da arepa, um dos principais alimentos da dieta desse país –, de fralda descartável a pasta de dente, de material escolar a medicamentos.

Há, certamente, mais de uma razão para explicar o índice de desabastecimento, que atinge 75% dos produtos monitorados pelo governo, e é quase certo também que ele exercerá uma influência decisiva nas próximas eleições parlamentares.

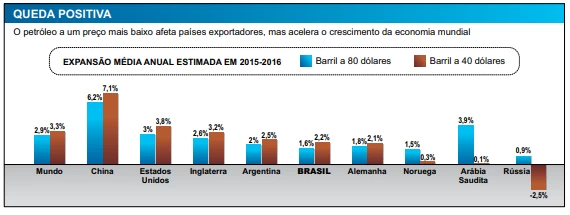

Há controle oficial de preços, ameaça a setores produtivos, falta de incentivo à indústria, desconfiança do mercado, ausência de crédito e uma série de questões que afetam as produções de bens e produtos. Nenhum grande país produtor de petróleo sentiu o impacto da fortíssima queda das cotações tanto quanto esse país, onde o petróleo responde por 96% das exportações.

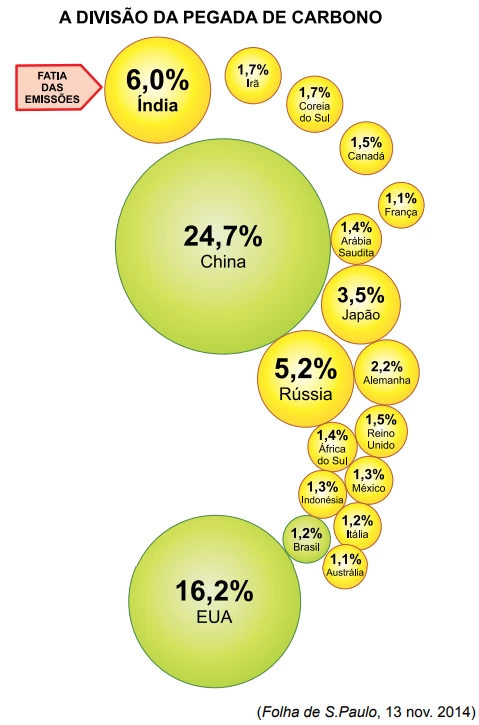

A questão climática vem preocupando a comunidade mundial - FGV 2016

Geografia - 2016A questão climática vem preocupando a comunidade mundial nos últimos anos. Criou-se, inclusive, o termo “pegada ecológica”, o rastro deixado por uma comunidade em função de seu índice de consumo, daí derivando os termos “pegada hídrica” e “pegada de carbono”, como se observa no gráfico a seguir.

Observe a caricatura a seguir do líder sírio Bashar al - FGV 2016

Geografia - 2016Observe a caricatura a seguir do líder sírio Bashar al-Assad.

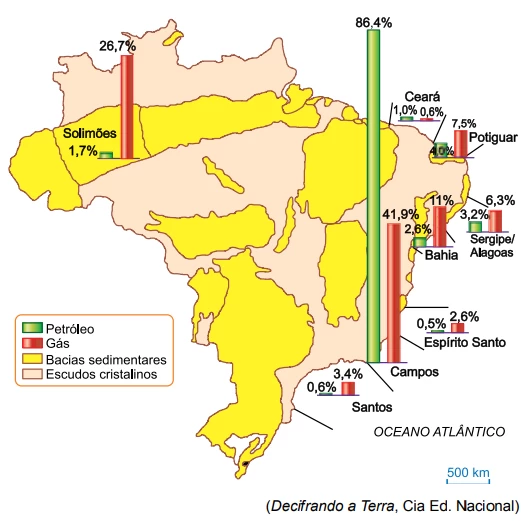

A ANP, Agência Nacional de Petróleo, responsável pela admin - FGV 2016

Geografia - 2016A ANP, Agência Nacional de Petróleo, responsável pela administração das reservas brasileiras de petróleo e gás em regime de monopólio estatal, informa que as jazidas brasileiras estão assim distribuídas:

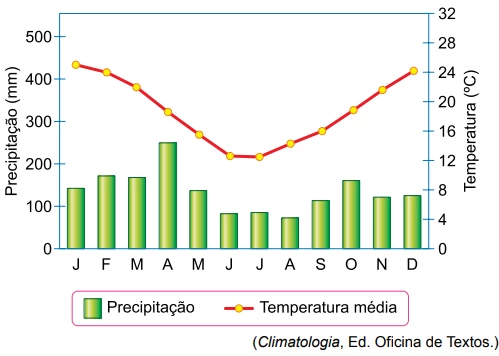

As variações de temperatura ao longo dos dias e noites nas - FGV 2016

Geografia - 2016As variações de temperatura ao longo dos dias e noites nas diferentes estações do ano causam expansão e contração térmica nos materiais rochosos, levando à fragmentação dos grãos minerais. Além disso, os minerais, com diferentes coeficientes de dilatação térmica, comportam-se de forma diferenciada às variações de temperatura, o que provoca deslocamento relativo entre os cristais, rompendo a coesão inicial entre os grãos.

As variações de temperatura ao longo dos dias e noites nas - FGV 2016

Geografia - 2016As variações de temperatura ao longo dos dias e noites nas diferentes estações do ano causam expansão e contração térmica nos materiais rochosos, levando à fragmentação dos grãos minerais. Além disso, os minerais, com diferentes coeficientes de dilatação térmica, comportam-se de forma diferenciada às variações de temperatura, o que provoca deslocamento relativo entre os cristais, rompendo a coesão inicial entre os grãos.

Um dos mais sérios problemas com o qual a Europa se - FGV 2016

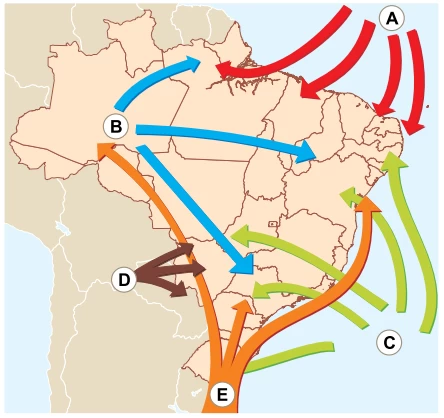

Geografia - 2016Um dos mais sérios problemas com o qual a Europa se defronta hoje em dia é a questão migratória. Não que isso seja novidade: ao longo de todo o século XX, a Europa sempre se viu às voltas com grupos que saíam do continente, ou para ele se dirigiam. Porém, atualmente, a migração se tornou uma questão traumática. O mapa a seguir, intitulado “Rotas de Fuga”, mostra os caminhos que os migrantes adotam.

As fotos a seguir mostram cinco diferentes tipos de formaçõ - FGV 2016

Geografia - 2016As fotos a seguir mostram cinco diferentes tipos de formações vegetais presentes nos ambientes brasileiros.

Analise o seguinte pluviograma:

Leia o texto a seguir. O país exportou menos armas em 2014 - FGV 2016