2014

Exibindo questões de 1 a 100.

A forma como se dá a construção do texto revela que - UNIFESP 2013

Língua Portuguesa - 2014Um sarau é o bocado mais delicioso que temos, de telhado abaixo. Em um sarau todo o mundo tem que fazer. O diplomata ajusta, com um copo de champagne na mão, os mais intrincados negócios; todos murmuram, e não há quem deixe de ser murmurado. O velho lembra-se dos minuetes e das cantigas do seu tempo, e o moço goza todos os regalos da sua época; as moças são no sarau como as estrelas no céu; estão no seu elemento: aqui uma, cantando suave cavatina, eleva-se vaidosa nas asas dos aplausos, por entre os quais surde, às vezes, um bravíssimo inopinado, que solta de lá da sala do jogo o parceiro que acaba de ganhar sua partida no écarté, mesmo na ocasião em que a moça se espicha completamente, desafinando um sustenido; daí a pouco vão outras, pelos braços de seus pares, se deslizando pela sala e marchando em seu passeio, mais a compasso que qualquer de nossos batalhões da Guarda Nacional, ao mesmo tempo que conversam sempre sobre objetos inocentes que movem olhaduras e risadinhas apreciáveis. Outras criticam de uma gorducha vovó, que ensaca nos bolsos meia bandeja de doces que veio para o chá, e que ela leva aos pequenos que, diz, lhe ficaram em casa. Ali vê-se um ataviado dandy que dirige mil finezas a uma senhora idosa, tendo os olhos pregados na sinhá, que senta-se ao lado. Finalmente, no sarau não é essencial ter cabeça nem boca, porque, para alguns é regra, durante ele, pensar pelos pés e falar pelos olhos.

E o mais é que nós estamos num sarau. Inúmeros batéis conduziram da corte para a ilha de... senhoras e senhores, recomendáveis por caráter e qualidades; alegre, numerosa e escolhida sociedade enche a grande casa, que brilha e mostra em toda a parte borbulhar o prazer e o bom gosto.

Entre todas essas elegantes e agradáveis moças, que com aturado empenho se esforçam para ver qual delas vence em graças, encantos e donaires, certo sobrepuja a travessa Moreninha, princesa daquela festa.

(Joaquim Manuel de Macedo. A Moreninha, 1997.)

No texto, há uma crítica àqueles que a) deixam de - UNIFESP 2014

Língua Portuguesa - 2014Do chuchu ao xixi

A concessionária Orla Rio subiu em 50%, de R$ 1 para R$ 1,50, o uso do banheiro público e de 60 para 65 anos o privilégio da gratuidade.

A idade foi elevada com base em lei estadual de 2002, um ano antes de o Estatuto do Idoso (2003) favorecer pessoas “com idade igual ou superior a 60 anos”.

Se o mal está feito, os economistas devem agora se preocupar com o choque do preço do uso do banheiro público na meta da inflação.

Em 1977, rimos quando a ditadura culpou o chuchu. Não seria o caso de rir, na democracia, do impacto do xixi no custo de vida?

(CartaCapital, 27.06.2012.)

O autor mostra que a concessionária Orla Rio procedeu - UNIFESP 2014

Língua Portuguesa - 2014Do chuchu ao xixi

A concessionária Orla Rio subiu em 50%, de R$ 1 para R$ 1,50, o uso do banheiro público e de 60 para 65 anos o privilégio da gratuidade.

A idade foi elevada com base em lei estadual de 2002, um ano antes de o Estatuto do Idoso (2003) favorecer pessoas “com idade igual ou superior a 60 anos”.

Se o mal está feito, os economistas devem agora se preocupar com o choque do preço do uso do banheiro público na meta da inflação.

Em 1977, rimos quando a ditadura culpou o chuchu. Não seria o caso de rir, na democracia, do impacto do xixi no custo de vida?

(CartaCapital, 27.06.2012.)

A ideia comum entre o poema de Drummond e o texto de - UNIFESP 2013

Língua Portuguesa - 2014O silêncio é a matéria significante por excelência, um continuum significante. O real da comunicação é o silêncio. E como o nosso objeto de reflexão é o discurso, chegamos a uma outra afirmação que sucede a essa: o silêncio é o real do discurso.

O homem está “condenado” a significar. Com ou sem palavras, diante do mundo, há uma injunção à “interpretação”: tudo tem de fazer sentido (qualquer que ele seja). O homem está irremediavelmente constituído pela sua relação com o simbólico.

Numa certa perspectiva, a dominante nos estudos dos signos, se produz uma sobreposição entre linguagem (verbal e não-verbal) e significação.

Disso decorreu um recobrimento dessas duas noções, resultando uma redução pela qual qualquer matéria significante fala, isto é, é remetida à linguagem (sobretudo verbal) para que lhe seja atribuído sentido. Nessa mesma direção, coloca-se o “império do verbal” em nossas formas sociais: traduz-se o silêncio em palavras. Vê-se assim o silêncio como linguagem e perde-se sua especificidade, enquanto matéria significan te distinta da linguagem.

(Eni Orlandi. As formas do silêncio, 1997.)

Assinale as alternativas que completam a) warmed b) - UNIFESP 2014

Inglês - 2014Climate change: warm words and cool waters

There is a serious debate about why observed temperatures have not kept pace with computer-modelled predictions

September 1, 2013

Editorial The Guardian

Last week’s report that the current “pause” in global warming could be linked to cyclic cooling in the Pacific will be interpreted by climate sceptics as evidence that global warming isn’t happening, and by politicians as a reason to forget about climate change and carry on with business as usual. Both responses would be dangerously wrong.

There is no serious argument within climate science about the link between carbon dioxide levels and temperature. Between 1970 and 1998 the planet warmed at an average of 0.17C per decade, and from 1998 to 2012 at 0.04C per decade. Carbon dioxide levels in the atmosphere, however, continued to rise and are now higher than at any time in the last 800,000 years. Twelve of the 14 warmest years on record have occurred since 2000; the last two years have been marked by catastrophic floods in Australia and recordbreaking temperatures in the US; and the loss of north polar ice has accelerated at such a rate that climate modellers expect the Arctic Ocean to be routinely ice-free in September after 2040.

There is, however, a serious debate about why the observed temperatures have not kept pace with computermodelled predictions and where the heat that should have registered on the global thermometer has hidden itself. One guess – supported by some sustained but still incomplete research – is that the deep oceans are warming: that is, the extra heat that should be measurable in the atmosphere has been absorbed by the sea. This is hardly good news: atmosphere and ocean play on each other, and any stored heat is 44 to be returned to the atmosphere sooner or later, in unpredictable ways. The real lesson from the latest finding is that there is a lot yet to be understood about how the planet works, and precisely how ocean and atmosphere distribute 45 from the equator to the poles.

(www.theguardian.com. Adaptado.)

Assinale as alternativas que completam a) unlikable b) - UNIFESP 2014

Inglês - 2014Climate change: warm words and cool waters

There is a serious debate about why observed temperatures have not kept pace with computer-modelled predictions

September 1, 2013

Editorial The Guardian

Last week’s report that the current “pause” in global warming could be linked to cyclic cooling in the Pacific will be interpreted by climate sceptics as evidence that global warming isn’t happening, and by politicians as a reason to forget about climate change and carry on with business as usual. Both responses would be dangerously wrong.

There is no serious argument within climate science about the link between carbon dioxide levels and temperature. Between 1970 and 1998 the planet warmed at an average of 0.17C per decade, and from 1998 to 2012 at 0.04C per decade. Carbon dioxide levels in the atmosphere, however, continued to rise and are now higher than at any time in the last 800,000 years. Twelve of the 14 warmest years on record have occurred since 2000; the last two years have been marked by catastrophic floods in Australia and recordbreaking temperatures in the US; and the loss of north polar ice has accelerated at such a rate that climate modellers expect the Arctic Ocean to be routinely ice-free in September after 2040.

There is, however, a serious debate about why the observed temperatures have not kept pace with computermodelled predictions and where the heat that should have registered on the global thermometer has hidden itself. One guess – supported by some sustained but still incomplete research – is that the deep oceans are warming: that is, the extra heat that should be measurable in the atmosphere has been absorbed by the sea. This is hardly good news: atmosphere and ocean play on each other, and any stored heat is 44 to be returned to the atmosphere sooner or later, in unpredictable ways. The real lesson from the latest finding is that there is a lot yet to be understood about how the planet works, and precisely how ocean and atmosphere distribute 45 from the equator to the poles.

(www.theguardian.com. Adaptado.)

No trecho do terceiro parágrafo – the deep oceans are - UNIFESP 2014

Inglês - 2014Climate change: warm words and cool waters

There is a serious debate about why observed temperatures have not kept pace with computer-modelled predictions

September 1, 2013

Editorial The Guardian

Last week’s report that the current “pause” in global warming could be linked to cyclic cooling in the Pacific will be interpreted by climate sceptics as evidence that global warming isn’t happening, and by politicians as a reason to forget about climate change and carry on with business as usual. Both responses would be dangerously wrong.

There is no serious argument within climate science about the link between carbon dioxide levels and temperature. Between 1970 and 1998 the planet warmed at an average of 0.17C per decade, and from 1998 to 2012 at 0.04C per decade. Carbon dioxide levels in the atmosphere, however, continued to rise and are now higher than at any time in the last 800,000 years. Twelve of the 14 warmest years on record have occurred since 2000; the last two years have been marked by catastrophic floods in Australia and recordbreaking temperatures in the US; and the loss of north polar ice has accelerated at such a rate that climate modellers expect the Arctic Ocean to be routinely ice-free in September after 2040.

There is, however, a serious debate about why the observed temperatures have not kept pace with computermodelled predictions and where the heat that should have registered on the global thermometer has hidden itself. One guess – supported by some sustained but still incomplete research – is that the deep oceans are warming: that is, the extra heat that should be measurable in the atmosphere has been absorbed by the sea. This is hardly good news: atmosphere and ocean play on each other, and any stored heat is 44 to be returned to the atmosphere sooner or later, in unpredictable ways. The real lesson from the latest finding is that there is a lot yet to be understood about how the planet works, and precisely how ocean and atmosphere distribute 45 from the equator to the poles.

(www.theguardian.com. Adaptado.)

As informações apresentadas no segundo parágrafo apoiam - UNIFESP 2014

Inglês - 2014Climate change: warm words and cool waters

There is a serious debate about why observed temperatures have not kept pace with computer-modelled predictions

September 1, 2013

Editorial The Guardian

Last week’s report that the current “pause” in global warming could be linked to cyclic cooling in the Pacific will be interpreted by climate sceptics as evidence that global warming isn’t happening, and by politicians as a reason to forget about climate change and carry on with business as usual. Both responses would be dangerously wrong.

There is no serious argument within climate science about the link between carbon dioxide levels and temperature. Between 1970 and 1998 the planet warmed at an average of 0.17C per decade, and from 1998 to 2012 at 0.04C per decade. Carbon dioxide levels in the atmosphere, however, continued to rise and are now higher than at any time in the last 800,000 years. Twelve of the 14 warmest years on record have occurred since 2000; the last two years have been marked by catastrophic floods in Australia and recordbreaking temperatures in the US; and the loss of north polar ice has accelerated at such a rate that climate modellers expect the Arctic Ocean to be routinely ice-free in September after 2040.

There is, however, a serious debate about why the observed temperatures have not kept pace with computermodelled predictions and where the heat that should have registered on the global thermometer has hidden itself. One guess – supported by some sustained but still incomplete research – is that the deep oceans are warming: that is, the extra heat that should be measurable in the atmosphere has been absorbed by the sea. This is hardly good news: atmosphere and ocean play on each other, and any stored heat is 44 to be returned to the atmosphere sooner or later, in unpredictable ways. The real lesson from the latest finding is that there is a lot yet to be understood about how the planet works, and precisely how ocean and atmosphere distribute 45 from the equator to the poles.

(www.theguardian.com. Adaptado.)

No trecho do último parágrafo – The constant dance - UNIFESP 2014

Inglês - 2014

No one knows why music has such a potent effect on our emotions. But thanks to some recent studies we have a few intriguing clues. Why do we like music? Like most good questions, this one works on many levels. We have answers on some levels, but not all.

We like music because it makes us feel good. Why does it make us feel good? In 2001, neuroscientists Anne Blood and Robert Zatorre at McGill University in Montreal provided an answer. Using magnetic resonance imaging they showed that people listening to pleasurable music had activated brain regions called the limbic and paralimbic areas, which are connected to euphoric reward responses, like those we experience from sex, good food and addictive drugs. Those rewards come from a gush of a neurotransmitter called dopamine. As DJ Lee Haslam told us, music is the drug. But why? It’s easy enough to understand why sex and food are rewarded with a dopamine rush: this makes us want more, and so contributes to our survival and propagation. (Some drugs subvert that survival instinct by stimulating dopamine release on false pretences.) But why would a sequence of sounds with no obvious survival value do the same thing?

The truth is no one knows. However, we now have many clues to why music provokes intense emotions. The current favourite theory among scientists who study the cognition of music – how we process it mentally – dates back to 1956, when the philosopher and composer Leonard Meyer suggested that emotion in music is all about what we expect, and whether or not we get it. Meyer drew on earlier psychological theories of emotion, which proposed that it arises when we’re unable to satisfy some desire. That, as you might imagine, creates frustration or anger – but if we then find what we’re looking for, be it love or a cigarette, the payoff is all the sweeter.

This, Meyer argued, is what music does too. It sets up sonic patterns and regularities that tempt us to make unconscious predictions about what’s coming next. If we’re right, the brain gives itself a little reward – as we’d now see it, a surge of dopamine. The constant dance between expectation and outcome thus enlivens the brain with a pleasurable play of emotions.

(www.bbc.com. Adaptado.)

No trecho do último parágrafo – as we’d now see it - UNIFESP 2014

Inglês - 2014

No one knows why music has such a potent effect on our emotions. But thanks to some recent studies we have a few intriguing clues. Why do we like music? Like most good questions, this one works on many levels. We have answers on some levels, but not all.

We like music because it makes us feel good. Why does it make us feel good? In 2001, neuroscientists Anne Blood and Robert Zatorre at McGill University in Montreal provided an answer. Using magnetic resonance imaging they showed that people listening to pleasurable music had activated brain regions called the limbic and paralimbic areas, which are connected to euphoric reward responses, like those we experience from sex, good food and addictive drugs. Those rewards come from a gush of a neurotransmitter called dopamine. As DJ Lee Haslam told us, music is the drug. But why? It’s easy enough to understand why sex and food are rewarded with a dopamine rush: this makes us want more, and so contributes to our survival and propagation. (Some drugs subvert that survival instinct by stimulating dopamine release on false pretences.) But why would a sequence of sounds with no obvious survival value do the same thing?

The truth is no one knows. However, we now have many clues to why music provokes intense emotions. The current favourite theory among scientists who study the cognition of music – how we process it mentally – dates back to 1956, when the philosopher and composer Leonard Meyer suggested that emotion in music is all about what we expect, and whether or not we get it. Meyer drew on earlier psychological theories of emotion, which proposed that it arises when we’re unable to satisfy some desire. That, as you might imagine, creates frustration or anger – but if we then find what we’re looking for, be it love or a cigarette, the payoff is all the sweeter.

This, Meyer argued, is what music does too. It sets up sonic patterns and regularities that tempt us to make unconscious predictions about what’s coming next. If we’re right, the brain gives itself a little reward – as we’d now see it, a surge of dopamine. The constant dance between expectation and outcome thus enlivens the brain with a pleasurable play of emotions.

(www.bbc.com. Adaptado.)

O trecho final do quarto parágrafo – the payoff is all - UNIFESP 2014

Língua Portuguesa - 2014

No one knows why music has such a potent effect on our emotions. But thanks to some recent studies we have a few intriguing clues. Why do we like music? Like most good questions, this one works on many levels. We have answers on some levels, but not all.

We like music because it makes us feel good. Why does it make us feel good? In 2001, neuroscientists Anne Blood and Robert Zatorre at McGill University in Montreal provided an answer. Using magnetic resonance imaging they showed that people listening to pleasurable music had activated brain regions called the limbic and paralimbic areas, which are connected to euphoric reward responses, like those we experience from sex, good food and addictive drugs. Those rewards come from a gush of a neurotransmitter called dopamine. As DJ Lee Haslam told us, music is the drug. But why? It’s easy enough to understand why sex and food are rewarded with a dopamine rush: this makes us want more, and so contributes to our survival and propagation. (Some drugs subvert that survival instinct by stimulating dopamine release on false pretences.) But why would a sequence of sounds with no obvious survival value do the same thing?

The truth is no one knows. However, we now have many clues to why music provokes intense emotions. The current favourite theory among scientists who study the cognition of music – how we process it mentally – dates back to 1956, when the philosopher and composer Leonard Meyer suggested that emotion in music is all about what we expect, and whether or not we get it. Meyer drew on earlier psychological theories of emotion, which proposed that it arises when we’re unable to satisfy some desire. That, as you might imagine, creates frustration or anger – but if we then find what we’re looking for, be it love or a cigarette, the payoff is all the sweeter.

This, Meyer argued, is what music does too. It sets up sonic patterns and regularities that tempt us to make unconscious predictions about what’s coming next. If we’re right, the brain gives itself a little reward – as we’d now see it, a surge of dopamine. The constant dance between expectation and outcome thus enlivens the brain with a pleasurable play of emotions.

(www.bbc.com. Adaptado.)

No trecho do quarto parágrafo – However, we now have - UNIFESP 2014

Inglês - 2014

No one knows why music has such a potent effect on our emotions. But thanks to some recent studies we have a few intriguing clues. Why do we like music? Like most good questions, this one works on many levels. We have answers on some levels, but not all.

We like music because it makes us feel good. Why does it make us feel good? In 2001, neuroscientists Anne Blood and Robert Zatorre at McGill University in Montreal provided an answer. Using magnetic resonance imaging they showed that people listening to pleasurable music had activated brain regions called the limbic and paralimbic areas, which are connected to euphoric reward responses, like those we experience from sex, good food and addictive drugs. Those rewards come from a gush of a neurotransmitter called dopamine. As DJ Lee Haslam told us, music is the drug. But why? It’s easy enough to understand why sex and food are rewarded with a dopamine rush: this makes us want more, and so contributes to our survival and propagation. (Some drugs subvert that survival instinct by stimulating dopamine release on false pretences.) But why would a sequence of sounds with no obvious survival value do the same thing?

The truth is no one knows. However, we now have many clues to why music provokes intense emotions. The current favourite theory among scientists who study the cognition of music – how we process it mentally – dates back to 1956, when the philosopher and composer Leonard Meyer suggested that emotion in music is all about what we expect, and whether or not we get it. Meyer drew on earlier psychological theories of emotion, which proposed that it arises when we’re unable to satisfy some desire. That, as you might imagine, creates frustration or anger – but if we then find what we’re looking for, be it love or a cigarette, the payoff is all the sweeter.

This, Meyer argued, is what music does too. It sets up sonic patterns and regularities that tempt us to make unconscious predictions about what’s coming next. If we’re right, the brain gives itself a little reward – as we’d now see it, a surge of dopamine. The constant dance between expectation and outcome thus enlivens the brain with a pleasurable play of emotions.

(www.bbc.com. Adaptado.)

Segundo Leonard Meyer, a) a ansiedade e comportamentos - UNIFESP 2014

Língua Portuguesa - 2014

No one knows why music has such a potent effect on our emotions. But thanks to some recent studies we have a few intriguing clues. Why do we like music? Like most good questions, this one works on many levels. We have answers on some levels, but not all.

We like music because it makes us feel good. Why does it make us feel good? In 2001, neuroscientists Anne Blood and Robert Zatorre at McGill University in Montreal provided an answer. Using magnetic resonance imaging they showed that people listening to pleasurable music had activated brain regions called the limbic and paralimbic areas, which are connected to euphoric reward responses, like those we experience from sex, good food and addictive drugs. Those rewards come from a gush of a neurotransmitter called dopamine. As DJ Lee Haslam told us, music is the drug. But why? It’s easy enough to understand why sex and food are rewarded with a dopamine rush: this makes us want more, and so contributes to our survival and propagation. (Some drugs subvert that survival instinct by stimulating dopamine release on false pretences.) But why would a sequence of sounds with no obvious survival value do the same thing?

The truth is no one knows. However, we now have many clues to why music provokes intense emotions. The current favourite theory among scientists who study the cognition of music – how we process it mentally – dates back to 1956, when the philosopher and composer Leonard Meyer suggested that emotion in music is all about what we expect, and whether or not we get it. Meyer drew on earlier psychological theories of emotion, which proposed that it arises when we’re unable to satisfy some desire. That, as you might imagine, creates frustration or anger – but if we then find what we’re looking for, be it love or a cigarette, the payoff is all the sweeter.

This, Meyer argued, is what music does too. It sets up sonic patterns and regularities that tempt us to make unconscious predictions about what’s coming next. If we’re right, the brain gives itself a little reward – as we’d now see it, a surge of dopamine. The constant dance between expectation and outcome thus enlivens the brain with a pleasurable play of emotions.

(www.bbc.com. Adaptado.)

Segundo as informações apresentadas no terceiro e - UNIFESP 2014

Inglês - 2014

No one knows why music has such a potent effect on our emotions. But thanks to some recent studies we have a few intriguing clues. Why do we like music? Like most good questions, this one works on many levels. We have answers on some levels, but not all.

We like music because it makes us feel good. Why does it make us feel good? In 2001, neuroscientists Anne Blood and Robert Zatorre at McGill University in Montreal provided an answer. Using magnetic resonance imaging they showed that people listening to pleasurable music had activated brain regions called the limbic and paralimbic areas, which are connected to euphoric reward responses, like those we experience from sex, good food and addictive drugs. Those rewards come from a gush of a neurotransmitter called dopamine. As DJ Lee Haslam told us, music is the drug. But why? It’s easy enough to understand why sex and food are rewarded with a dopamine rush: this makes us want more, and so contributes to our survival and propagation. (Some drugs subvert that survival instinct by stimulating dopamine release on false pretences.) But why would a sequence of sounds with no obvious survival value do the same thing?

The truth is no one knows. However, we now have many clues to why music provokes intense emotions. The current favourite theory among scientists who study the cognition of music – how we process it mentally – dates back to 1956, when the philosopher and composer Leonard Meyer suggested that emotion in music is all about what we expect, and whether or not we get it. Meyer drew on earlier psychological theories of emotion, which proposed that it arises when we’re unable to satisfy some desire. That, as you might imagine, creates frustration or anger – but if we then find what we’re looking for, be it love or a cigarette, the payoff is all the sweeter.

This, Meyer argued, is what music does too. It sets up sonic patterns and regularities that tempt us to make unconscious predictions about what’s coming next. If we’re right, the brain gives itself a little reward – as we’d now see it, a surge of dopamine. The constant dance between expectation and outcome thus enlivens the brain with a pleasurable play of emotions.

(www.bbc.com. Adaptado.)

No trecho final do segundo parágrafo – As DJ Lee Haslam - UNIFESP 2014

Inglês - 2014No trecho final do segundo parágrafo – As DJ Lee Haslam

told us, music is the drug. –, é possível substituir a palavra as, sem alteração de sentido, por

No trecho do segundo parágrafo – which are connected - UNIFESP 2014

Inglês - 2014

No one knows why music has such a potent effect on our emotions. But thanks to some recent studies we have a few intriguing clues. Why do we like music? Like most good questions, this one works on many levels. We have answers on some levels, but not all.

We like music because it makes us feel good. Why does it make us feel good? In 2001, neuroscientists Anne Blood and Robert Zatorre at McGill University in Montreal provided an answer. Using magnetic resonance imaging they showed that people listening to pleasurable music had activated brain regions called the limbic and paralimbic areas, which are connected to euphoric reward responses, like those we experience from sex, good food and addictive drugs. Those rewards come from a gush of a neurotransmitter called dopamine. As DJ Lee Haslam told us, music is the drug. But why? It’s easy enough to understand why sex and food are rewarded with a dopamine rush: this makes us want more, and so contributes to our survival and propagation. (Some drugs subvert that survival instinct by stimulating dopamine release on false pretences.) But why would a sequence of sounds with no obvious survival value do the same thing?

The truth is no one knows. However, we now have many clues to why music provokes intense emotions. The current favourite theory among scientists who study the cognition of music – how we process it mentally – dates back to 1956, when the philosopher and composer Leonard Meyer suggested that emotion in music is all about what we expect, and whether or not we get it. Meyer drew on earlier psychological theories of emotion, which proposed that it arises when we’re unable to satisfy some desire. That, as you might imagine, creates frustration or anger – but if we then find what we’re looking for, be it love or a cigarette, the payoff is all the sweeter.

This, Meyer argued, is what music does too. It sets up sonic patterns and regularities that tempt us to make unconscious predictions about what’s coming next. If we’re right, the brain gives itself a little reward – as we’d now see it, a surge of dopamine. The constant dance between expectation and outcome thus enlivens the brain with a pleasurable play of emotions.

(www.bbc.com. Adaptado.)

O texto relaciona a música às drogas porque ambas a) - UNIFESP 2014

Inglês - 2014

No one knows why music has such a potent effect on our emotions. But thanks to some recent studies we have a few intriguing clues. Why do we like music? Like most good questions, this one works on many levels. We have answers on some levels, but not all.

We like music because it makes us feel good. Why does it make us feel good? In 2001, neuroscientists Anne Blood and Robert Zatorre at McGill University in Montreal provided an answer. Using magnetic resonance imaging they showed that people listening to pleasurable music had activated brain regions called the limbic and paralimbic areas, which are connected to euphoric reward responses, like those we experience from sex, good food and addictive drugs. Those rewards come from a gush of a neurotransmitter called dopamine. As DJ Lee Haslam told us, music is the drug. But why? It’s easy enough to understand why sex and food are rewarded with a dopamine rush: this makes us want more, and so contributes to our survival and propagation. (Some drugs subvert that survival instinct by stimulating dopamine release on false pretences.) But why would a sequence of sounds with no obvious survival value do the same thing?

The truth is no one knows. However, we now have many clues to why music provokes intense emotions. The current favourite theory among scientists who study the cognition of music – how we process it mentally – dates back to 1956, when the philosopher and composer Leonard Meyer suggested that emotion in music is all about what we expect, and whether or not we get it. Meyer drew on earlier psychological theories of emotion, which proposed that it arises when we’re unable to satisfy some desire. That, as you might imagine, creates frustration or anger – but if we then find what we’re looking for, be it love or a cigarette, the payoff is all the sweeter.

This, Meyer argued, is what music does too. It sets up sonic patterns and regularities that tempt us to make unconscious predictions about what’s coming next. If we’re right, the brain gives itself a little reward – as we’d now see it, a surge of dopamine. The constant dance between expectation and outcome thus enlivens the brain with a pleasurable play of emotions.

(www.bbc.com. Adaptado.)

According to McGill University neuroscientists, music - UNIFESP 2014

Inglês - 2014

No one knows why music has such a potent effect on our emotions. But thanks to some recent studies we have a few intriguing clues. Why do we like music? Like most good questions, this one works on many levels. We have answers on some levels, but not all.

We like music because it makes us feel good. Why does it make us feel good? In 2001, neuroscientists Anne Blood and Robert Zatorre at McGill University in Montreal provided an answer. Using magnetic resonance imaging they showed that people listening to pleasurable music had activated brain regions called the limbic and paralimbic areas, which are connected to euphoric reward responses, like those we experience from sex, good food and addictive drugs. Those rewards come from a gush of a neurotransmitter called dopamine. As DJ Lee Haslam told us, music is the drug. But why? It’s easy enough to understand why sex and food are rewarded with a dopamine rush: this makes us want more, and so contributes to our survival and propagation. (Some drugs subvert that survival instinct by stimulating dopamine release on false pretences.) But why would a sequence of sounds with no obvious survival value do the same thing?

The truth is no one knows. However, we now have many clues to why music provokes intense emotions. The current favourite theory among scientists who study the cognition of music – how we process it mentally – dates back to 1956, when the philosopher and composer Leonard Meyer suggested that emotion in music is all about what we expect, and whether or not we get it. Meyer drew on earlier psychological theories of emotion, which proposed that it arises when we’re unable to satisfy some desire. That, as you might imagine, creates frustration or anger – but if we then find what we’re looking for, be it love or a cigarette, the payoff is all the sweeter.

This, Meyer argued, is what music does too. It sets up sonic patterns and regularities that tempt us to make unconscious predictions about what’s coming next. If we’re right, the brain gives itself a little reward – as we’d now see it, a surge of dopamine. The constant dance between expectation and outcome thus enlivens the brain with a pleasurable play of emotions.

(www.bbc.com. Adaptado.)

Segundo o texto, a pergunta apresentada no primeiro - UNIFESP 2014

Inglês - 2014

No one knows why music has such a potent effect on our emotions. But thanks to some recent studies we have a few intriguing clues. Why do we like music? Like most good questions, this one works on many levels. We have answers on some levels, but not all.

We like music because it makes us feel good. Why does it make us feel good? In 2001, neuroscientists Anne Blood and Robert Zatorre at McGill University in Montreal provided an answer. Using magnetic resonance imaging they showed that people listening to pleasurable music had activated brain regions called the limbic and paralimbic areas, which are connected to euphoric reward responses, like those we experience from sex, good food and addictive drugs. Those rewards come from a gush of a neurotransmitter called dopamine. As DJ Lee Haslam told us, music is the drug. But why? It’s easy enough to understand why sex and food are rewarded with a dopamine rush: this makes us want more, and so contributes to our survival and propagation. (Some drugs subvert that survival instinct by stimulating dopamine release on false pretences.) But why would a sequence of sounds with no obvious survival value do the same thing?

The truth is no one knows. However, we now have many clues to why music provokes intense emotions. The current favourite theory among scientists who study the cognition of music – how we process it mentally – dates back to 1956, when the philosopher and composer Leonard Meyer suggested that emotion in music is all about what we expect, and whether or not we get it. Meyer drew on earlier psychological theories of emotion, which proposed that it arises when we’re unable to satisfy some desire. That, as you might imagine, creates frustration or anger – but if we then find what we’re looking for, be it love or a cigarette, the payoff is all the sweeter.

This, Meyer argued, is what music does too. It sets up sonic patterns and regularities that tempt us to make unconscious predictions about what’s coming next. If we’re right, the brain gives itself a little reward – as we’d now see it, a surge of dopamine. The constant dance between expectation and outcome thus enlivens the brain with a pleasurable play of emotions.

(www.bbc.com. Adaptado.)

A alternativa em que o enunciado está de acordo com a - UNIFESP 2014

Língua Portuguesa - 2014A sensível

Foi então que ela atravessou uma crise que nada parecia ter a ver com sua vida: uma crise de profunda piedade. A cabeça tão limitada, tão bem penteada, mal podia suportar perdoar tanto. Não podia olhar o rosto de um tenor enquanto este cantava alegre – virava para o lado o rosto magoado, insuportável, por piedade, não suportando a glória do cantor. Na rua de repente comprimia o peito com as mãos enluvadas – assaltada de perdão. Sofria sem recompensa, sem mesmo a simpatia por si própria.

Essa mesma senhora, que sofreu de sensibilidade como de doença, escolheu um domingo em que o marido viajava para procurar a bordadeira. Era mais um passeio que uma necessidade. Isso ela sempre soubera: passear. Como se ainda fosse a menina que passeia na calçada. Sobretudo passeava muito quando “sentia” que o marido a enganava. Assim foi procurar a bordadeira, no domingo de manhã. Desceu uma rua cheia de lama, de galinhas e de crianças nuas – aonde fora se meter! A bordadeira, na casa cheia de filhos com cara de fome, o marido tuberculoso – a bordadeira recusou-se a bordar a toalha porque não gostava de fazer ponto de cruz! Saiu afrontada e perplexa. “Sentia-se” tão suja pelo calor da manhã, e um de seus prazeres era pensar que sempre, desde pequena, fora muito limpa. Em casa almoçou sozinha, deitou-se no quarto meio escurecido, cheia de sentimentos maduros e sem amargura. Oh pelo menos uma vez não “sentia” nada. Senão talvez a perplexidade diante da liberdade da bordadeira pobre. Senão talvez um sentimento de espera. A liberdade.

(Clarice Lispector. Os melhores contos de Clarice Lispector, 1996.)

O emprego do adjetivo “sensível” como substantivo, no - UNIFESP 2014

Língua Portuguesa - 2014A sensível

Foi então que ela atravessou uma crise que nada parecia ter a ver com sua vida: uma crise de profunda piedade. A cabeça tão limitada, tão bem penteada, mal podia suportar perdoar tanto. Não podia olhar o rosto de um tenor enquanto este cantava alegre – virava para o lado o rosto magoado, insuportável, por piedade, não suportando a glória do cantor. Na rua de repente comprimia o peito com as mãos enluvadas – assaltada de perdão. Sofria sem recompensa, sem mesmo a simpatia por si própria.

Essa mesma senhora, que sofreu de sensibilidade como de doença, escolheu um domingo em que o marido viajava para procurar a bordadeira. Era mais um passeio que uma necessidade. Isso ela sempre soubera: passear. Como se ainda fosse a menina que passeia na calçada. Sobretudo passeava muito quando “sentia” que o marido a enganava. Assim foi procurar a bordadeira, no domingo de manhã. Desceu uma rua cheia de lama, de galinhas e de crianças nuas – aonde fora se meter! A bordadeira, na casa cheia de filhos com cara de fome, o marido tuberculoso – a bordadeira recusou-se a bordar a toalha porque não gostava de fazer ponto de cruz! Saiu afrontada e perplexa. “Sentia-se” tão suja pelo calor da manhã, e um de seus prazeres era pensar que sempre, desde pequena, fora muito limpa. Em casa almoçou sozinha, deitou-se no quarto meio escurecido, cheia de sentimentos maduros e sem amargura. Oh pelo menos uma vez não “sentia” nada. Senão talvez a perplexidade diante da liberdade da bordadeira pobre. Senão talvez um sentimento de espera. A liberdade.

(Clarice Lispector. Os melhores contos de Clarice Lispector, 1996.)

A narrativa delineia entre as personagens da senhora e - UNIFESP 2014

Língua Portuguesa - 2014A sensível

Foi então que ela atravessou uma crise que nada parecia ter a ver com sua vida: uma crise de profunda piedade. A cabeça tão limitada, tão bem penteada, mal podia suportar perdoar tanto. Não podia olhar o rosto de um tenor enquanto este cantava alegre – virava para o lado o rosto magoado, insuportável, por piedade, não suportando a glória do cantor. Na rua de repente comprimia o peito com as mãos enluvadas – assaltada de perdão. Sofria sem recompensa, sem mesmo a simpatia por si própria.

Essa mesma senhora, que sofreu de sensibilidade como de doença, escolheu um domingo em que o marido viajava para procurar a bordadeira. Era mais um passeio que uma necessidade. Isso ela sempre soubera: passear. Como se ainda fosse a menina que passeia na calçada. Sobretudo passeava muito quando “sentia” que o marido a enganava. Assim foi procurar a bordadeira, no domingo de manhã. Desceu uma rua cheia de lama, de galinhas e de crianças nuas – aonde fora se meter! A bordadeira, na casa cheia de filhos com cara de fome, o marido tuberculoso – a bordadeira recusou-se a bordar a toalha porque não gostava de fazer ponto de cruz! Saiu afrontada e perplexa. “Sentia-se” tão suja pelo calor da manhã, e um de seus prazeres era pensar que sempre, desde pequena, fora muito limpa. Em casa almoçou sozinha, deitou-se no quarto meio escurecido, cheia de sentimentos maduros e sem amargura. Oh pelo menos uma vez não “sentia” nada. Senão talvez a perplexidade diante da liberdade da bordadeira pobre. Senão talvez um sentimento de espera. A liberdade.

(Clarice Lispector. Os melhores contos de Clarice Lispector, 1996.)

Leia os textos enviados a uma revista por dois de seus - UNIFESP 2014

Língua Portuguesa - 2014Leia os textos enviados a uma revista por dois de seus leitores.

Leitor 1: O alto número de óbitos entre as mulheres fez com que os cuidados com a saúde feminina se tornassem mais necessários. Hoje sabemos que estamos expostas a muitos fatores; por isso, conhecer os sintomas do infarto é fundamental.

Leitor 2: Os médicos devem se aprofundar nos estudos relacionados à saúde da mulher. A paciente, por sua vez, não pode deixar de se prevenir. Nesse processo, a informação, os recursos adequados e profissionais capacitados são determinantes para diminuir os infartos.

No título do poema – O nada que é –, ocorre a substan - UNIFESP 2015

Língua Portuguesa - 2014O nada que é

Um canavial tem a extensão

ante a qual todo metro é vão.

Tem o escancarado do mar

que existe para desafiar

que números e seus afins

possam prendê-lo nos seus sins.

Ante um canavial a medida

métrica é de todo esquecida,

porque embora todo povoado

povoa-o o pleno anonimato

que dá esse efeito singular:

de um nada prenhe como o mar.

(João Cabral de Melo Neto.

Museu de tudo e depois, 1988.)

O poema está organizado em versos de a) dez sílabas - UNIFESP 2014

Língua Portuguesa - 2014O nada que é

Um canavial tem a extensão

ante a qual todo metro é vão.

Tem o escancarado do mar

que existe para desafiar

que números e seus afins

possam prendê-lo nos seus sins.

Ante um canavial a medida

métrica é de todo esquecida,

porque embora todo povoado

povoa-o o pleno anonimato

que dá esse efeito singular:

de um nada prenhe como o mar.

(João Cabral de Melo Neto.

Museu de tudo e depois, 1988.)

Nos versos iniciais do poema – Um canavial tem a - UNIFESP 2014

Língua Portuguesa - 2014O nada que é

Um canavial tem a extensão

ante a qual todo metro é vão.

Tem o escancarado do mar

que existe para desafiar

que números e seus afins

possam prendê-lo nos seus sins.

Ante um canavial a medida

métrica é de todo esquecida,

porque embora todo povoado

povoa-o o pleno anonimato

que dá esse efeito singular:

de um nada prenhe como o mar.

(João Cabral de Melo Neto.

Museu de tudo e depois, 1988.)

Ao comparar o canavial ao mar, a imagem construída - UNIFESP 2014

Língua Portuguesa - 2014O nada que é

Um canavial tem a extensão

ante a qual todo metro é vão.

Tem o escancarado do mar

que existe para desafiar

que números e seus afins

possam prendê-lo nos seus sins.

Ante um canavial a medida

métrica é de todo esquecida,

porque embora todo povoado

povoa-o o pleno anonimato

que dá esse efeito singular:

de um nada prenhe como o mar.

(João Cabral de Melo Neto.

Museu de tudo e depois, 1988.)

Assinale a alternativa em que se analisa corretamente - UNIFESP 2014

Língua Portuguesa - 2014Poetas e tipógrafos

Vice-cônsul do Brasil em Barcelona em 1947, o poeta João Cabral de Melo Neto foi a um médico por causa de sua crônica dor de cabeça. Ele lhe receitou exercícios físicos, para “canalizar a tensão”. João Cabral seguiu o conselho. Comprou uma prensa manual e passou a produzir à mão, domesticamente, os próprios livros e os dos amigos. E, com tal “ginástica poética”, como a chamava, tornou-se essa ave rara e fascinante: um editor artesanal.

Um livro recém-lançado, “Editores Artesanais Brasileiros”, de Gisela Creni, conta a história de João Cabral e de outros sonhadores que, desde os anos 50, enriqueceram a cultura brasileira a partir de seu quarto dos fundos ou de um galpão no quintal.

O editor artesanal dispõe de uma minitipografia e faz tudo: escolhe a tipologia, compõe o texto, diagrama-o, produz as ilustrações, tira provas, revisa, compra o papel e imprime – em folhas soltas, não costuradas – 100 ou 200 lindos exemplares de um livrinho que, se não fosse por ele, nunca seria publicado. Daí, distribui-os aos subscritores (amigos que se comprometeram a comprar um exemplar). O resto, dá ao autor. Os livreiros não querem nem saber.

Foi assim que nasceram, em pequenos livros, poemas de – acredite ou não – João Cabral, Manuel Bandeira, Drummond, Cecília Meireles, Joaquim Cardozo, Vinicius de Moraes, Lêdo Ivo, Paulo Mendes Campos, Jorge de Lima e até o conto “Com o Vaqueiro Mariano” (1952), de Guimarães Rosa. E de Donne, Baudelaire, Lautréamont, Rimbaud, Mallarmé, Keats, Rilke, Eliot, Lorca, Cummings e outros, traduzidos por amor.

João Cabral não se curou da dor de cabeça, mas valeu.

(Ruy Castro. Folha de S.Paulo, 17.08.2013. Adaptado.)

Na passagem – O editor artesanal dispõe de uma - UNIFESP 2014

Língua Portuguesa - 2014Poetas e tipógrafos

Vice-cônsul do Brasil em Barcelona em 1947, o poeta João Cabral de Melo Neto foi a um médico por causa de sua crônica dor de cabeça. Ele lhe receitou exercícios físicos, para “canalizar a tensão”. João Cabral seguiu o conselho. Comprou uma prensa manual e passou a produzir à mão, domesticamente, os próprios livros e os dos amigos. E, com tal “ginástica poética”, como a chamava, tornou-se essa ave rara e fascinante: um editor artesanal.

Um livro recém-lançado, “Editores Artesanais Brasileiros”, de Gisela Creni, conta a história de João Cabral e de outros sonhadores que, desde os anos 50, enriqueceram a cultura brasileira a partir de seu quarto dos fundos ou de um galpão no quintal.

O editor artesanal dispõe de uma minitipografia e faz tudo: escolhe a tipologia, compõe o texto, diagrama-o, produz as ilustrações, tira provas, revisa, compra o papel e imprime – em folhas soltas, não costuradas – 100 ou 200 lindos exemplares de um livrinho que, se não fosse por ele, nunca seria publicado. Daí, distribui-os aos subscritores (amigos que se comprometeram a comprar um exemplar). O resto, dá ao autor. Os livreiros não querem nem saber.

Foi assim que nasceram, em pequenos livros, poemas de – acredite ou não – João Cabral, Manuel Bandeira, Drummond, Cecília Meireles, Joaquim Cardozo, Vinicius de Moraes, Lêdo Ivo, Paulo Mendes Campos, Jorge de Lima e até o conto “Com o Vaqueiro Mariano” (1952), de Guimarães Rosa. E de Donne, Baudelaire, Lautréamont, Rimbaud, Mallarmé, Keats, Rilke, Eliot, Lorca, Cummings e outros, traduzidos por amor.

João Cabral não se curou da dor de cabeça, mas valeu.

(Ruy Castro. Folha de S.Paulo, 17.08.2013. Adaptado.)

Na oração – como a chamava – (1.º parágrafo), o pro - UNIFESP 2014

Língua Portuguesa - 2014Poetas e tipógrafos

Vice-cônsul do Brasil em Barcelona em 1947, o poeta João Cabral de Melo Neto foi a um médico por causa de sua crônica dor de cabeça. Ele lhe receitou exercícios físicos, para “canalizar a tensão”. João Cabral seguiu o conselho. Comprou uma prensa manual e passou a produzir à mão, domesticamente, os próprios livros e os dos amigos. E, com tal “ginástica poética”, como a chamava, tornou-se essa ave rara e fascinante: um editor artesanal.

Um livro recém-lançado, “Editores Artesanais Brasileiros”, de Gisela Creni, conta a história de João Cabral e de outros sonhadores que, desde os anos 50, enriqueceram a cultura brasileira a partir de seu quarto dos fundos ou de um galpão no quintal.

O editor artesanal dispõe de uma minitipografia e faz tudo: escolhe a tipologia, compõe o texto, diagrama-o, produz as ilustrações, tira provas, revisa, compra o papel e imprime – em folhas soltas, não costuradas – 100 ou 200 lindos exemplares de um livrinho que, se não fosse por ele, nunca seria publicado. Daí, distribui-os aos subscritores (amigos que se comprometeram a comprar um exemplar). O resto, dá ao autor. Os livreiros não querem nem saber.

Foi assim que nasceram, em pequenos livros, poemas de – acredite ou não – João Cabral, Manuel Bandeira, Drummond, Cecília Meireles, Joaquim Cardozo, Vinicius de Moraes, Lêdo Ivo, Paulo Mendes Campos, Jorge de Lima e até o conto “Com o Vaqueiro Mariano” (1952), de Guimarães Rosa. E de Donne, Baudelaire, Lautréamont, Rimbaud, Mallarmé, Keats, Rilke, Eliot, Lorca, Cummings e outros, traduzidos por amor.

João Cabral não se curou da dor de cabeça, mas valeu.

(Ruy Castro. Folha de S.Paulo, 17.08.2013. Adaptado.)

Vice-cônsul do Brasil em Barcelona em 1947, o poeta - UNIFESP 2014

Língua Portuguesa - 2014Poetas e tipógrafos

Vice-cônsul do Brasil em Barcelona em 1947, o poeta João Cabral de Melo Neto foi a um médico por causa de sua crônica dor de cabeça. Ele lhe receitou exercícios físicos, para “canalizar a tensão”. João Cabral seguiu o conselho. Comprou uma prensa manual e passou a produzir à mão, domesticamente, os próprios livros e os dos amigos. E, com tal “ginástica poética”, como a chamava, tornou-se essa ave rara e fascinante: um editor artesanal.

Um livro recém-lançado, “Editores Artesanais Brasileiros”, de Gisela Creni, conta a história de João Cabral e de outros sonhadores que, desde os anos 50, enriqueceram a cultura brasileira a partir de seu quarto dos fundos ou de um galpão no quintal.

O editor artesanal dispõe de uma minitipografia e faz tudo: escolhe a tipologia, compõe o texto, diagrama-o, produz as ilustrações, tira provas, revisa, compra o papel e imprime – em folhas soltas, não costuradas – 100 ou 200 lindos exemplares de um livrinho que, se não fosse por ele, nunca seria publicado. Daí, distribui-os aos subscritores (amigos que se comprometeram a comprar um exemplar). O resto, dá ao autor. Os livreiros não querem nem saber.

Foi assim que nasceram, em pequenos livros, poemas de – acredite ou não – João Cabral, Manuel Bandeira, Drummond, Cecília Meireles, Joaquim Cardozo, Vinicius de Moraes, Lêdo Ivo, Paulo Mendes Campos, Jorge de Lima e até o conto “Com o Vaqueiro Mariano” (1952), de Guimarães Rosa. E de Donne, Baudelaire, Lautréamont, Rimbaud, Mallarmé, Keats, Rilke, Eliot, Lorca, Cummings e outros, traduzidos por amor.

João Cabral não se curou da dor de cabeça, mas valeu.

(Ruy Castro. Folha de S.Paulo, 17.08.2013. Adaptado.)

Com a frase – tornou-se essa ave rara e fascinante - UNIFESP 2014

Língua Portuguesa - 2014Poetas e tipógrafos

Vice-cônsul do Brasil em Barcelona em 1947, o poeta João Cabral de Melo Neto foi a um médico por causa de sua crônica dor de cabeça. Ele lhe receitou exercícios físicos, para “canalizar a tensão”. João Cabral seguiu o conselho. Comprou uma prensa manual e passou a produzir à mão, domesticamente, os próprios livros e os dos amigos. E, com tal “ginástica poética”, como a chamava, tornou-se essa ave rara e fascinante: um editor artesanal.

Um livro recém-lançado, “Editores Artesanais Brasileiros”, de Gisela Creni, conta a história de João Cabral e de outros sonhadores que, desde os anos 50, enriqueceram a cultura brasileira a partir de seu quarto dos fundos ou de um galpão no quintal.

O editor artesanal dispõe de uma minitipografia e faz tudo: escolhe a tipologia, compõe o texto, diagrama-o, produz as ilustrações, tira provas, revisa, compra o papel e imprime – em folhas soltas, não costuradas – 100 ou 200 lindos exemplares de um livrinho que, se não fosse por ele, nunca seria publicado. Daí, distribui-os aos subscritores (amigos que se comprometeram a comprar um exemplar). O resto, dá ao autor. Os livreiros não querem nem saber.

Foi assim que nasceram, em pequenos livros, poemas de – acredite ou não – João Cabral, Manuel Bandeira, Drummond, Cecília Meireles, Joaquim Cardozo, Vinicius de Moraes, Lêdo Ivo, Paulo Mendes Campos, Jorge de Lima e até o conto “Com o Vaqueiro Mariano” (1952), de Guimarães Rosa. E de Donne, Baudelaire, Lautréamont, Rimbaud, Mallarmé, Keats, Rilke, Eliot, Lorca, Cummings e outros, traduzidos por amor.

João Cabral não se curou da dor de cabeça, mas valeu.

(Ruy Castro. Folha de S.Paulo, 17.08.2013. Adaptado.)

As informações do texto permitem afirmar que a) a - UNIFESP 2014

Língua Portuguesa - 2014Poetas e tipógrafos

Vice-cônsul do Brasil em Barcelona em 1947, o poeta João Cabral de Melo Neto foi a um médico por causa de sua crônica dor de cabeça. Ele lhe receitou exercícios físicos, para “canalizar a tensão”. João Cabral seguiu o conselho. Comprou uma prensa manual e passou a produzir à mão, domesticamente, os próprios livros e os dos amigos. E, com tal “ginástica poética”, como a chamava, tornou-se essa ave rara e fascinante: um editor artesanal.

Um livro recém-lançado, “Editores Artesanais Brasileiros”, de Gisela Creni, conta a história de João Cabral e de outros sonhadores que, desde os anos 50, enriqueceram a cultura brasileira a partir de seu quarto dos fundos ou de um galpão no quintal.

O editor artesanal dispõe de uma minitipografia e faz tudo: escolhe a tipologia, compõe o texto, diagrama-o, produz as ilustrações, tira provas, revisa, compra o papel e imprime – em folhas soltas, não costuradas – 100 ou 200 lindos exemplares de um livrinho que, se não fosse por ele, nunca seria publicado. Daí, distribui-os aos subscritores (amigos que se comprometeram a comprar um exemplar). O resto, dá ao autor. Os livreiros não querem nem saber.

Foi assim que nasceram, em pequenos livros, poemas de – acredite ou não – João Cabral, Manuel Bandeira, Drummond, Cecília Meireles, Joaquim Cardozo, Vinicius de Moraes, Lêdo Ivo, Paulo Mendes Campos, Jorge de Lima e até o conto “Com o Vaqueiro Mariano” (1952), de Guimarães Rosa. E de Donne, Baudelaire, Lautréamont, Rimbaud, Mallarmé, Keats, Rilke, Eliot, Lorca, Cummings e outros, traduzidos por amor.

João Cabral não se curou da dor de cabeça, mas valeu.

(Ruy Castro. Folha de S.Paulo, 17.08.2013. Adaptado.)

De acordo com o texto, é correto afirmar que a) - UNIFESP 2014

Língua Portuguesa - 2014

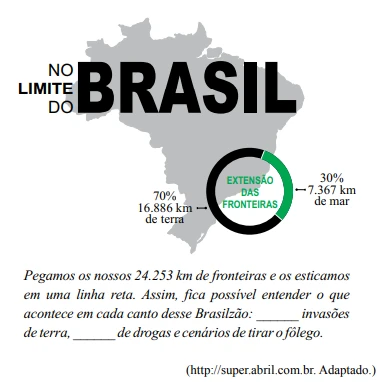

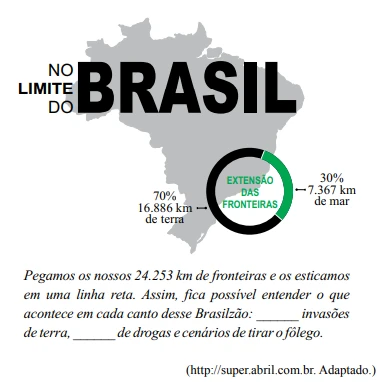

As lacunas do texto são preenchidas, correta e - UNIFESP 2014

Língua Portuguesa - 2014

A leitura do trecho de O primo Basílio, em seu - UNIFESP 2014

Língua Portuguesa - 2014O melro veio com efeito às três horas. Luísa estava na sala, ao piano.

— Está ali o sujeito do costume – foi dizer Juliana.

Luísa voltou-se corada, escandalizada da expressão:

— Ah! meu primo Basílio? Mande entrar.

E chamando-a:

— Ouça, se vier o Sr. Sebastião, ou alguém, que entre.

Era o primo! O sujeito, as suas visitas perderam de repente para ela todo o interesse picante. A sua malícia cheia, enfunada até aí, caiu, engelhou-se como uma vela a que falta o vento. Ora, adeus! Era o primo!

Subiu à cozinha, devagar, — lograda.

— Temos grande novidade, Sr.ª Joana! O tal peralta é primo. Diz que é o primo Basílio.

E com um risinho:

— É o Basílio! Ora o Basílio! Sai-nos primo à última hora! O diabo tem graça!

— Então que havia de o homem ser se não parente? – observou Joana.

Juliana não respondeu. Quis saber se estava o ferro pronto, que tinha uma carga de roupa para passar! E sentou-se à janela, esperando. O céu baixo e pardo pesava, carregado de eletricidade; às vezes uma aragem súbita e fina punha nas folhagens dos quintais um arrepio trêmulo.

— É o primo! – refletia ela. – E só vem então quando o marido se vai. Boa! E fica-se toda no ar quando ele sai; e é roupa-branca e mais roupa-branca, e roupão novo, e tipoia para o passeio, e suspiros e olheiras! Boa bêbeda! Tudo fica na família!

Os olhos luziam-lhe. Já se não sentia tão lograda. Havia ali muito “para ver e para escutar”. E o ferro estava pronto?

Mas a campainha, embaixo, tocou.

(Eça de Queirós. O primo Basílio, 1993.)

O trecho do texto reescrito sem prejuízo para o sentido - UNIFESP 2014

Língua Portuguesa - 2014O melro veio com efeito às três horas. Luísa estava na sala, ao piano.

— Está ali o sujeito do costume – foi dizer Juliana.

Luísa voltou-se corada, escandalizada da expressão:

— Ah! meu primo Basílio? Mande entrar.

E chamando-a:

— Ouça, se vier o Sr. Sebastião, ou alguém, que entre.

Era o primo! O sujeito, as suas visitas perderam de repente para ela todo o interesse picante. A sua malícia cheia, enfunada até aí, caiu, engelhou-se como uma vela a que falta o vento. Ora, adeus! Era o primo!

Subiu à cozinha, devagar, — lograda.

— Temos grande novidade, Sr.ª Joana! O tal peralta é primo. Diz que é o primo Basílio.

E com um risinho:

— É o Basílio! Ora o Basílio! Sai-nos primo à última hora! O diabo tem graça!

— Então que havia de o homem ser se não parente? – observou Joana.

Juliana não respondeu. Quis saber se estava o ferro pronto, que tinha uma carga de roupa para passar! E sentou-se à janela, esperando. O céu baixo e pardo pesava, carregado de eletricidade; às vezes uma aragem súbita e fina punha nas folhagens dos quintais um arrepio trêmulo.

— É o primo! – refletia ela. – E só vem então quando o marido se vai. Boa! E fica-se toda no ar quando ele sai; e é roupa-branca e mais roupa-branca, e roupão novo, e tipoia para o passeio, e suspiros e olheiras! Boa bêbeda! Tudo fica na família!

Os olhos luziam-lhe. Já se não sentia tão lograda. Havia ali muito “para ver e para escutar”. E o ferro estava pronto?

Mas a campainha, embaixo, tocou.

(Eça de Queirós. O primo Basílio, 1993.)

A leitura do parágrafo permite concluir que as - UNIFESP 2014

Língua Portuguesa - 2014O melro veio com efeito às três horas. Luísa estava na sala, ao piano.

— Está ali o sujeito do costume – foi dizer Juliana.

Luísa voltou-se corada, escandalizada da expressão:

— Ah! meu primo Basílio? Mande entrar.

E chamando-a:

— Ouça, se vier o Sr. Sebastião, ou alguém, que entre.

Era o primo! O sujeito, as suas visitas perderam de repente para ela todo o interesse picante. A sua malícia cheia, enfunada até aí, caiu, engelhou-se como uma vela a que falta o vento. Ora, adeus! Era o primo!

Subiu à cozinha, devagar, — lograda.

— Temos grande novidade, Sr.ª Joana! O tal peralta é primo. Diz que é o primo Basílio.

E com um risinho:

— É o Basílio! Ora o Basílio! Sai-nos primo à última hora! O diabo tem graça!

— Então que havia de o homem ser se não parente? – observou Joana.

Juliana não respondeu. Quis saber se estava o ferro pronto, que tinha uma carga de roupa para passar! E sentou-se à janela, esperando. O céu baixo e pardo pesava, carregado de eletricidade; às vezes uma aragem súbita e fina punha nas folhagens dos quintais um arrepio trêmulo.

— É o primo! – refletia ela. – E só vem então quando o marido se vai. Boa! E fica-se toda no ar quando ele sai; e é roupa-branca e mais roupa-branca, e roupão novo, e tipoia para o passeio, e suspiros e olheiras! Boa bêbeda! Tudo fica na família!

Os olhos luziam-lhe. Já se não sentia tão lograda. Havia ali muito “para ver e para escutar”. E o ferro estava pronto?

Mas a campainha, embaixo, tocou.

(Eça de Queirós. O primo Basílio, 1993.)

Considere o antepenúltimo parágrafo do texto— É o primo! – refletia ela. – E só vem então quando o marido se vai. Boa! E fica-se toda no ar quando ele sai; e é roupa-branca e mais roupa-branca, e roupão novo, e tipoia para o passeio, e suspiros e olheiras! Boa bêbeda! Tudo fica na família!

Nas reflexões de Juliana, está sugerido o que acaba - UNIFESP 2014

Língua Portuguesa - 2014O melro veio com efeito às três horas. Luísa estava na sala, ao piano.

— Está ali o sujeito do costume – foi dizer Juliana.

Luísa voltou-se corada, escandalizada da expressão:

— Ah! meu primo Basílio? Mande entrar.

E chamando-a:

— Ouça, se vier o Sr. Sebastião, ou alguém, que entre.

Era o primo! O sujeito, as suas visitas perderam de repente para ela todo o interesse picante. A sua malícia cheia, enfunada até aí, caiu, engelhou-se como uma vela a que falta o vento. Ora, adeus! Era o primo!

Subiu à cozinha, devagar, — lograda.

— Temos grande novidade, Sr.ª Joana! O tal peralta é primo. Diz que é o primo Basílio.

E com um risinho:

— É o Basílio! Ora o Basílio! Sai-nos primo à última hora! O diabo tem graça!

— Então que havia de o homem ser se não parente? – observou Joana.

Juliana não respondeu. Quis saber se estava o ferro pronto, que tinha uma carga de roupa para passar! E sentou-se à janela, esperando. O céu baixo e pardo pesava, carregado de eletricidade; às vezes uma aragem súbita e fina punha nas folhagens dos quintais um arrepio trêmulo.

— É o primo! – refletia ela. – E só vem então quando o marido se vai. Boa! E fica-se toda no ar quando ele sai; e é roupa-branca e mais roupa-branca, e roupão novo, e tipoia para o passeio, e suspiros e olheiras! Boa bêbeda! Tudo fica na família!

Os olhos luziam-lhe. Já se não sentia tão lograda. Havia ali muito “para ver e para escutar”. E o ferro estava pronto?

Mas a campainha, embaixo, tocou.

(Eça de Queirós. O primo Basílio, 1993.)

Considere o antepenúltimo parágrafo do texto— É o primo! – refletia ela. – E só vem então quando o marido se vai. Boa! E fica-se toda no ar quando ele sai; e é roupa-branca e mais roupa-branca, e roupão novo, e tipoia para o passeio, e suspiros e olheiras! Boa bêbeda! Tudo fica na família!

Observe as passagens do texto: – Ora, adeus! Era o - UNIFESP 2014

Língua Portuguesa - 2014O melro veio com efeito às três horas. Luísa estava na sala, ao piano.

— Está ali o sujeito do costume – foi dizer Juliana.

Luísa voltou-se corada, escandalizada da expressão:

— Ah! meu primo Basílio? Mande entrar.

E chamando-a:

— Ouça, se vier o Sr. Sebastião, ou alguém, que entre.

Era o primo! O sujeito, as suas visitas perderam de repente para ela todo o interesse picante. A sua malícia cheia, enfunada até aí, caiu, engelhou-se como uma vela a que falta o vento. Ora, adeus! Era o primo!

Subiu à cozinha, devagar, — lograda.

— Temos grande novidade, Sr.ª Joana! O tal peralta é primo. Diz que é o primo Basílio.

E com um risinho:

— É o Basílio! Ora o Basílio! Sai-nos primo à última hora! O diabo tem graça!

— Então que havia de o homem ser se não parente? – observou Joana.

Juliana não respondeu. Quis saber se estava o ferro pronto, que tinha uma carga de roupa para passar! E sentou-se à janela, esperando. O céu baixo e pardo pesava, carregado de eletricidade; às vezes uma aragem súbita e fina punha nas folhagens dos quintais um arrepio trêmulo.

— É o primo! – refletia ela. – E só vem então quando o marido se vai. Boa! E fica-se toda no ar quando ele sai; e é roupa-branca e mais roupa-branca, e roupão novo, e tipoia para o passeio, e suspiros e olheiras! Boa bêbeda! Tudo fica na família!

Os olhos luziam-lhe. Já se não sentia tão lograda. Havia ali muito “para ver e para escutar”. E o ferro estava pronto?

Mas a campainha, embaixo, tocou.

(Eça de Queirós. O primo Basílio, 1993.)

Quando é avisada de que Basílio estava em sua casa - UNIFESP 2014

Língua Portuguesa - 2014O melro veio com efeito às três horas. Luísa estava na sala, ao piano.

— Está ali o sujeito do costume – foi dizer Juliana.

Luísa voltou-se corada, escandalizada da expressão:

— Ah! meu primo Basílio? Mande entrar.

E chamando-a:

— Ouça, se vier o Sr. Sebastião, ou alguém, que entre.

Era o primo! O sujeito, as suas visitas perderam de repente para ela todo o interesse picante. A sua malícia cheia, enfunada até aí, caiu, engelhou-se como uma vela a que falta o vento. Ora, adeus! Era o primo!

Subiu à cozinha, devagar, — lograda.

— Temos grande novidade, Sr.ª Joana! O tal peralta é primo. Diz que é o primo Basílio.

E com um risinho:

— É o Basílio! Ora o Basílio! Sai-nos primo à última hora! O diabo tem graça!

— Então que havia de o homem ser se não parente? – observou Joana.

Juliana não respondeu. Quis saber se estava o ferro pronto, que tinha uma carga de roupa para passar! E sentou-se à janela, esperando. O céu baixo e pardo pesava, carregado de eletricidade; às vezes uma aragem súbita e fina punha nas folhagens dos quintais um arrepio trêmulo.

— É o primo! – refletia ela. – E só vem então quando o marido se vai. Boa! E fica-se toda no ar quando ele sai; e é roupa-branca e mais roupa-branca, e roupão novo, e tipoia para o passeio, e suspiros e olheiras! Boa bêbeda! Tudo fica na família!

Os olhos luziam-lhe. Já se não sentia tão lograda. Havia ali muito “para ver e para escutar”. E o ferro estava pronto?

Mas a campainha, embaixo, tocou.

(Eça de Queirós. O primo Basílio, 1993.)

Para que a fala do pescador seja coerente, as lacunas - UNIFESP 2014

Língua Portuguesa - 2014

Nesse soneto, são comuns as inversões, como se vê no - UNIFESP 2014

Língua Portuguesa - 2014Onde estou? Este sítio desconheço:

Quem fez tão diferente aquele prado?

Tudo outra natureza tem tomado;

E em contemplá-lo tímido esmoreço.

Uma fonte aqui houve; eu não me esqueço

De estar a ela um dia reclinado;

Ali em vale um monte está mudado:

Quanto pode dos anos o progresso!

Árvores aqui vi tão florescentes,

Que faziam perpétua a primavera:

Nem troncos vejo agora decadentes.

Eu me engano: a região esta não era;

Mas que venho a estranhar, se estão presentes

Meus males, com que tudo degenera!

(Obras, 1996.)

No contexto em que estão empregados, os termos sítio - UNIFESP 2014

Língua Portuguesa - 2014Onde estou? Este sítio desconheço:

Quem fez tão diferente aquele prado?

Tudo outra natureza tem tomado;

E em contemplá-lo tímido esmoreço.

Uma fonte aqui houve; eu não me esqueço

De estar a ela um dia reclinado;

Ali em vale um monte está mudado:

Quanto pode dos anos o progresso!

Árvores aqui vi tão florescentes,

Que faziam perpétua a primavera:

Nem troncos vejo agora decadentes.

Eu me engano: a região esta não era;

Mas que venho a estranhar, se estão presentes

Meus males, com que tudo degenera!

(Obras, 1996.)

No soneto, o eu lírico expressa-se de forma a) eufórica - UNIFESP 2014

Língua Portuguesa - 2014Onde estou? Este sítio desconheço:

Quem fez tão diferente aquele prado?

Tudo outra natureza tem tomado;

E em contemplá-lo tímido esmoreço.

Uma fonte aqui houve; eu não me esqueço

De estar a ela um dia reclinado;

Ali em vale um monte está mudado:

Quanto pode dos anos o progresso!

Árvores aqui vi tão florescentes,

Que faziam perpétua a primavera:

Nem troncos vejo agora decadentes.

Eu me engano: a região esta não era;

Mas que venho a estranhar, se estão presentes

Meus males, com que tudo degenera!

(Obras, 1996.)

São recursos expressivos e tema presentes no soneto - UNIFESP 2014

Língua Portuguesa - 2014Onde estou? Este sítio desconheço:

Quem fez tão diferente aquele prado?

Tudo outra natureza tem tomado;

E em contemplá-lo tímido esmoreço.

Uma fonte aqui houve; eu não me esqueço

De estar a ela um dia reclinado;

Ali em vale um monte está mudado:

Quanto pode dos anos o progresso!

Árvores aqui vi tão florescentes,

Que faziam perpétua a primavera:

Nem troncos vejo agora decadentes.

Eu me engano: a região esta não era;

Mas que venho a estranhar, se estão presentes

Meus males, com que tudo degenera!

(Obras, 1996.)

Os substantivos do texto derivados pelo mesmo processo - UNIFESP 2014

Língua Portuguesa - 2014Casimiro de Abreu pertence à geração dos poetas que morreram prematuramente, na casa dos vinte anos, como Álvares de Azevedo e outros, acometidos do “mal” byroniano. Sua poesia, reflexo autobiográfico dos transes, imaginários e verídicos, que lhe agitaram a curta existência, centra-se em dois temas fundamentais: a saudade e o lirismo amoroso. Graças a tal fundo de juvenilidade e timidez, sua poesia saudosista guarda um não sei quê de infantil.

(Massaud Moisés.

A literatura brasileira através dos textos, 2004. Adaptado.)

Os versos de Casimiro de Abreu que se aproximam da - UNIFESP 2014

Língua Portuguesa - 2014Casimiro de Abreu pertence à geração dos poetas que morreram prematuramente, na casa dos vinte anos, como Álvares de Azevedo e outros, acometidos do “mal” byroniano. Sua poesia, reflexo autobiográfico dos transes, imaginários e verídicos, que lhe agitaram a curta existência, centra-se em dois temas fundamentais: a saudade e o lirismo amoroso. Graças a tal fundo de juvenilidade e timidez, sua poesia saudosista guarda um não sei quê de infantil.

(Massaud Moisés.

A literatura brasileira através dos textos, 2004. Adaptado.)

Mantida a norma-padrão da língua portuguesa, a frase - UNIFESP 2014

Língua Portuguesa - 2014

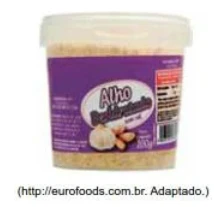

Dona Patrícia comprou um frasco com 100 gramas de alho t - VUNESP 2014

Biologia - 2014Dona Patrícia comprou um frasco com 100 gramas de alho triturado desidratado, sem sal ou qualquer conservante. A embalagem informava que o produto correspondia a 1 quilograma de alho fresco.

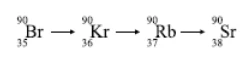

Um casal procurou ajuda médica, pois há anos desejava - VUNESP 2014

Biologia - 2014Um casal procurou ajuda médica, pois há anos desejava gerar filhos e não obtinha sucesso. Os exames apontaram que a mulher era reprodutivamente normal. Com relação ao homem, o exame revelou que a espermatogênese era comprometida por uma alteração cromossômica, embora seu fenótipo e desempenho sexual fossem normais. Por causa dessa alteração, não ocorria o pareamento dos cromossomos homólogos, a meiose não avançava além do zigóteno e os espermatócitos I degeneravam.

Leia os versos da canção “Carcará”, de José Cândido e - VUNESP 2014

Biologia - 2014Leia os versos da canção “Carcará”, de José Cândido e João do Vale.

Carcará

Carcará

Lá no Sertão

É um bicho que “avoa” que nem avião

É um pássaro malvado

Tem o bico “volteado” que nem gavião

Carcará

Quando vê roça queimada

Sai voando e cantando

Carcará

Vai fazer sua caçada

Carcará

Come “inté” cobra queimada

Mas quando chega o tempo da invernada

No Sertão não tem mais roça queimada

Carcará mesmo assim num passa fome

Os “burrego que nasce” na baixada

Carcará

Pega, mata e come

Carcará

Num vai morrer de fome

Carcará

Mais coragem do que homem

Carcará

Pega, mata e come

Carcará

é malvado, é valentão

É a águia de lá do meu Sertão

Os “burrego novinho” num pode andar

Ele puxa o “imbigo” “inté” matar

Carcará

Pega, mata e come

Carcará

Num vai morrer de fome

Carcará

Mais coragem do que homem

Carcará

Pega, mata e come

Em alguns estados dos Estados Unidos, a doença de Lyme - VUNESP 2014

Biologia - 2014Em alguns estados dos Estados Unidos, a doença de Lyme é um problema de saúde pública. Cerca de 30 mil casos são notificados por ano. A doença é causada pela bactéria Borrelia burgdorferi, transmitida ao homem por carrapatos que parasitam veados. Porém, um estudo de 2012 descobriu que a incidência da doença de Lyme nas últimas décadas não coincidiu com a abundância de veados, mas com um declínio na população de raposas-vermelhas, que comem camundongos-de-patas-brancas, uma espécie oportunista que prospera com a fragmentação de florestas devido à ocupação humana.

O livro Cultura do narcisismo, escrito por Christopher - VUNESP 2014

Física - 2014Texto 1

O livro Cultura do narcisismo, escrito por Christopher Lasch em 1979, é um clássico. O texto de Lasch mostra como o que era diagnosticado como patologia narcísica ou limítrofe nos anos 50 torna-se uma espécie de “normalidade compulsória” depois de duas décadas. Para que alguém seja considerado “bem-sucedido”, é trivialmente esperado que manipule sua própria imagem como se fosse um personagem, com a consequente perda do sentimento de autenticidade.

(Christian Dunker. “A cultura da indiferença”. www.mentecerebro.com.br. Adaptado.)

Texto 2

Zigmunt Bauman: Afastar-se da percepção de mundo consumista e do tipo de atitude individualista contra o mundo e as pessoas não é uma questão a ponderar, mas uma obrigação determinada pelos limites de sustentabilidade desse modelo da vida que pressupõe a infinidade de crescimento econômico. Segundo esse modelo, a felicidade está obrigatoriamente vinculada ao acesso a lojas e ao consumo exacerbado.

Não há livro didático, prova de vestibular ou resposta - VUNESP 2014

Filosofia - 2014Não há livro didático, prova de vestibular ou resposta correta do Enem que não atribua a miséria e os confli- tos internos da África a um fator principal: a partilha do continente africano pelos europeus. Essas fronteiras te- riam acotovelado no mesmo território diversas nações e grupos étnicos, fazendo o caos imperar na África. Porém, guerras entre nações rivais e disputas pela sucessão de tronos existiam muito antes de os europeus atingirem o interior da África. Graves conflitos étnicos aconteceram também em países que tiveram suas fronteiras mantidas pelos governos europeus. É incrível que uma teoria tão frágil e generalista tenha durado tanto – provavelmente isso acontece porque ela serve para alimentar a condes- cendência de quem toma os africanos como “bons sel- vagens” e tenta isentá-los da responsabilidade por seus problemas.

IHU On-Line – A medicalização de condutas classificadas - VUNESP 2014

Filosofia - 2014IHU On-Line – A medicalização de condutas classificadas como “anormais” se estendeu a praticamente todos os domínios de nossa existência. A quem interessa a medicalização da vida?

Sandra Caponi – A muitas pessoas. Em primeiro lugar ao saber médico, aos psiquiatras, mas também aos médicos gerais e especialistas. Interessa muito especialmente aos laboratórios farmacêuticos que, desse modo, podem vender seus medicamentos e ampliar o mercado de consumidores de psicofármacos de modo quase indefinido. Porém, esse interesse seria irrelevante se não existisse uma demanda social que aceita e até solicita que uma ampla variedade de comportamentos cotidianos ingresse no domínio do patológico. Um exemplo bastante óbvio é a escola. Crianças com problemas de comportamento mais ou menos sérios hoje recebem rapidamente um diagnóstico psiquiátrico. São medicadas, respondem à medicação e atingem o objetivo social procurado. Essas crianças que tomam ritalina ou antipsicóticos ficam mais calmas, mais sossegadas, concentradas e, ao mesmo tempo, mais tristes e isoladas.

Numa decisão para lá de polêmica, o juiz federal Eu - VUNESP 2014

Filosofia - 2014Numa decisão para lá de polêmica, o juiz federal Eu- gênio Rosa de Araújo, da 17.ª Vara Federal do Rio, indeferiu pedido do Ministério Público para que fossem retirados da rede vídeos tidos como ofensivos à umbanda e ao candomblé. No despacho, o magistrado afirmou que esses sistemas de crenças “não contêm os traços necessários de uma religião" por não terem um texto-base, uma estrutura hierárquica nem “um Deus a ser venerado". Para mim, esse é um belo caso de conclusão certa pelas razões erradas. Creio que o juiz agiu bem ao não censurar os filmes, mas meteu os pés pelas mãos ao justificar a decisão. Ao contrário do Ministério Público, não penso que vreligiões devam ser imunes à crítica. Se algum evangélico julga que o candomblé está associado ao diabo, deve ter a liberdade de dizê-lo. Como não podemos nem sequer estabelecer se Deus e o demônio existem, o mais lógico é que prevaleça a liberdade de dizer qualquer coisa.

Projeto no Iraque reduz a idade mínima de casamento - VUNESP 2014

Língua Portuguesa - 2014Projeto no Iraque reduz a idade mínima de casamento para xiitas mulheres para 9 anos. Xiitas iraquianas, caso o texto seja aprovado, só poderão sair de casa com autorização do marido e deverão estar sempre disponíveis para relações sexuais. Esse tipo de notícia coloca em xeque os ungidos multiculturalistas ocidentais. Como, segundo estes, não há culturas atrasadas mas apenas “diferentes”, e porque a democracia, entendida apenas como escolha da maioria, é um valor absoluto, por que condenar quando a maioria de um povo escolhe por voto a sharia*? Chegamos ao impasse dos multiculturalistas: aceitam que cada cultura seja “apenas diferente” e que, portanto, não há bárbaros, ou constatam o óbvio, ou seja, que certas sociedades ainda vivem presas a valores abjetos, que ignoram completamente as liberdades básicas dos indivíduos. Qual vai ser a opção?

Escrever mal é difícil, declarou um dos maiores escritor - VUNESP 2014