2015

Exibindo questões de 1 a 100.

B) daqui a 70 anos os atuais antibióticos estarão todos - UNIFESP 2015

Inglês - 2015Leia o texto para responder a questão.

The Rise of Antibiotic Resistance

By The Editorial Board

May 10, 2014

The World Health Organization has surveyed the growth of antibiotic-resistant germs around the world – the first such survey it has ever conducted – and come up with disturbing findings. In a report issued late last month, the organization found that antimicrobial resistance in bacteria (the main focus of the report), fungi, viruses and parasites is an increasingly serious threat in every part of the world. “A problem so serious that it threatens the achievements of modern medicine,” the organization said. “A post-antibiotic era, in which common infections and minor injuries can kill, far from being an apocalyptic fantasy, is instead a very real possibility for the 21st century.”

The growth of antibiotic-resistant pathogens means that in ever more cases, standard treatments no longer work, infections are harder or impossible to control, the risk of spreading infections to others is increased, and illnesses and hospital stays are prolonged. All of these drive up the costs of illnesses and the risk of death. The survey sought to determine the scope of the problem by asking countries to submit their most recent surveillance data (114 did so). Unfortunately, the data was glaringly incomplete because few countries track and monitor antibiotic resistance comprehensively, and there is no standard methodology for doing so.

Still, it is clear that major resistance problems have already developed, both for antibiotics that are used routinely and for those deemed “last resort” treatments to cure people when all else has failed. Carbapenem antibiotics, a class of drugs used as a last resort to treat life-threatening infections caused by a common intestinal bacterium, have failed to work in more than half the people treated in some countries. The bacterium is a major cause of hospital-acquired infections such as pneumonia, bloodstream infections, and infections in newborns and intensive-care patients. Similarly, the failure of a last-resort treatment for gonorrhoea has been confirmed in 10 countries, including many with advanced health care systems, such as Australia, Canada, France, Sweden and Britain. And resistance to a class of antibiotics that is routinely used to treat urinary tract infections caused by E. coli is widespread; in some countries the drugs are now ineffective in more than half of the patients treated. This sobering report is intended to kick-start a global campaign to develop tools and standards to track drug resistance, measure its health and economic impact, and design solutions.

The most urgent need is to minimize the overuse of antibiotics in medicine and agriculture, which accelerates the development of resistant strains. In the United States, the Food and Drug Administration (FDA) has issued voluntary guidelines calling on drug companies, animal producers and veterinarians to stop indiscriminately using antibiotics that are important for treating humans on livestock; the drug companies have said they will comply. But the agency, shortsightedly, has appealed a court order requiring it to ban the use of penicillin and two forms of tetracycline by animal producers to promote growth unless they provide proof that it will not promote drug-resistant microbes.

The pharmaceutical industry needs to be encouraged to develop new antibiotics to supplement those that are losing their effectiveness. The Royal Pharmaceutical Society, which represents pharmacists in Britain, called this month for stronger financial incentives. It said that no new class of antibiotics has been discovered since 1987, largely because the financial returns for finding new classes of antibiotics are too low. Unlike lucrative drugs to treat chronic diseases like cancer and cardiovascular ailments, antibiotics are typically taken for a short period of time, and any new drug is apt to be used sparingly and held in reserve to treat patients resistant to existing drugs. Antibiotics have transformed medicine and saved countless lives over the past seven decades. Now, rampant overuse and the lack of new drugs in the pipeline threaten to undermine their effectiveness.

(www.nytimes.com. Adaptado.)

Segundo o último parágrafo do texto, (A) os antibiótico - UNIFESP 2015

Inglês - 2015Leia o texto para responder a questão.

The Rise of Antibiotic Resistance

By The Editorial Board

May 10, 2014

The World Health Organization has surveyed the growth of antibiotic-resistant germs around the world – the first such survey it has ever conducted – and come up with disturbing findings. In a report issued late last month, the organization found that antimicrobial resistance in bacteria (the main focus of the report), fungi, viruses and parasites is an increasingly serious threat in every part of the world. “A problem so serious that it threatens the achievements of modern medicine,” the organization said. “A post-antibiotic era, in which common infections and minor injuries can kill, far from being an apocalyptic fantasy, is instead a very real possibility for the 21st century.”

The growth of antibiotic-resistant pathogens means that in ever more cases, standard treatments no longer work, infections are harder or impossible to control, the risk of spreading infections to others is increased, and illnesses and hospital stays are prolonged. All of these drive up the costs of illnesses and the risk of death. The survey sought to determine the scope of the problem by asking countries to submit their most recent surveillance data (114 did so). Unfortunately, the data was glaringly incomplete because few countries track and monitor antibiotic resistance comprehensively, and there is no standard methodology for doing so.

Still, it is clear that major resistance problems have already developed, both for antibiotics that are used routinely and for those deemed “last resort” treatments to cure people when all else has failed. Carbapenem antibiotics, a class of drugs used as a last resort to treat life-threatening infections caused by a common intestinal bacterium, have failed to work in more than half the people treated in some countries. The bacterium is a major cause of hospital-acquired infections such as pneumonia, bloodstream infections, and infections in newborns and intensive-care patients. Similarly, the failure of a last-resort treatment for gonorrhoea has been confirmed in 10 countries, including many with advanced health care systems, such as Australia, Canada, France, Sweden and Britain. And resistance to a class of antibiotics that is routinely used to treat urinary tract infections caused by E. coli is widespread; in some countries the drugs are now ineffective in more than half of the patients treated. This sobering report is intended to kick-start a global campaign to develop tools and standards to track drug resistance, measure its health and economic impact, and design solutions.

The most urgent need is to minimize the overuse of antibiotics in medicine and agriculture, which accelerates the development of resistant strains. In the United States, the Food and Drug Administration (FDA) has issued voluntary guidelines calling on drug companies, animal producers and veterinarians to stop indiscriminately using antibiotics that are important for treating humans on livestock; the drug companies have said they will comply. But the agency, shortsightedly, has appealed a court order requiring it to ban the use of penicillin and two forms of tetracycline by animal producers to promote growth unless they provide proof that it will not promote drug-resistant microbes.

The pharmaceutical industry needs to be encouraged to develop new antibiotics to supplement those that are losing their effectiveness. The Royal Pharmaceutical Society, which represents pharmacists in Britain, called this month for stronger financial incentives. It said that no new class of antibiotics has been discovered since 1987, largely because the financial returns for finding new classes of antibiotics are too low. Unlike lucrative drugs to treat chronic diseases like cancer and cardiovascular ailments, antibiotics are typically taken for a short period of time, and any new drug is apt to be used sparingly and held in reserve to treat patients resistant to existing drugs. Antibiotics have transformed medicine and saved countless lives over the past seven decades. Now, rampant overuse and the lack of new drugs in the pipeline threaten to undermine their effectiveness.

(www.nytimes.com. Adaptado.)

Segundo o texto, a Royal Pharmaceutical Society do - UNIFESP 2015

Inglês - 2015Leia o texto para responder a questão.

The Rise of Antibiotic Resistance

By The Editorial Board

May 10, 2014

The World Health Organization has surveyed the growth of antibiotic-resistant germs around the world – the first such survey it has ever conducted – and come up with disturbing findings. In a report issued late last month, the organization found that antimicrobial resistance in bacteria (the main focus of the report), fungi, viruses and parasites is an increasingly serious threat in every part of the world. “A problem so serious that it threatens the achievements of modern medicine,” the organization said. “A post-antibiotic era, in which common infections and minor injuries can kill, far from being an apocalyptic fantasy, is instead a very real possibility for the 21st century.”

The growth of antibiotic-resistant pathogens means that in ever more cases, standard treatments no longer work, infections are harder or impossible to control, the risk of spreading infections to others is increased, and illnesses and hospital stays are prolonged. All of these drive up the costs of illnesses and the risk of death. The survey sought to determine the scope of the problem by asking countries to submit their most recent surveillance data (114 did so). Unfortunately, the data was glaringly incomplete because few countries track and monitor antibiotic resistance comprehensively, and there is no standard methodology for doing so.

Still, it is clear that major resistance problems have already developed, both for antibiotics that are used routinely and for those deemed “last resort” treatments to cure people when all else has failed. Carbapenem antibiotics, a class of drugs used as a last resort to treat life-threatening infections caused by a common intestinal bacterium, have failed to work in more than half the people treated in some countries. The bacterium is a major cause of hospital-acquired infections such as pneumonia, bloodstream infections, and infections in newborns and intensive-care patients. Similarly, the failure of a last-resort treatment for gonorrhoea has been confirmed in 10 countries, including many with advanced health care systems, such as Australia, Canada, France, Sweden and Britain. And resistance to a class of antibiotics that is routinely used to treat urinary tract infections caused by E. coli is widespread; in some countries the drugs are now ineffective in more than half of the patients treated. This sobering report is intended to kick-start a global campaign to develop tools and standards to track drug resistance, measure its health and economic impact, and design solutions.

The most urgent need is to minimize the overuse of antibiotics in medicine and agriculture, which accelerates the development of resistant strains. In the United States, the Food and Drug Administration (FDA) has issued voluntary guidelines calling on drug companies, animal producers and veterinarians to stop indiscriminately using antibiotics that are important for treating humans on livestock; the drug companies have said they will comply. But the agency, shortsightedly, has appealed a court order requiring it to ban the use of penicillin and two forms of tetracycline by animal producers to promote growth unless they provide proof that it will not promote drug-resistant microbes.

The pharmaceutical industry needs to be encouraged to develop new antibiotics to supplement those that are losing their effectiveness. The Royal Pharmaceutical Society, which represents pharmacists in Britain, called this month for stronger financial incentives. It said that no new class of antibiotics has been discovered since 1987, largely because the financial returns for finding new classes of antibiotics are too low. Unlike lucrative drugs to treat chronic diseases like cancer and cardiovascular ailments, antibiotics are typically taken for a short period of time, and any new drug is apt to be used sparingly and held in reserve to treat patients resistant to existing drugs. Antibiotics have transformed medicine and saved countless lives over the past seven decades. Now, rampant overuse and the lack of new drugs in the pipeline threaten to undermine their effectiveness.

(www.nytimes.com. Adaptado.)

No trecho do quarto parágrafo “has appealed a court - UNIFESP 2015

Inglês - 2015Leia o texto para responder a questão.

The Rise of Antibiotic Resistance

By The Editorial Board

May 10, 2014

The World Health Organization has surveyed the growth of antibiotic-resistant germs around the world – the first such survey it has ever conducted – and come up with disturbing findings. In a report issued late last month, the organization found that antimicrobial resistance in bacteria (the main focus of the report), fungi, viruses and parasites is an increasingly serious threat in every part of the world. “A problem so serious that it threatens the achievements of modern medicine,” the organization said. “A post-antibiotic era, in which common infections and minor injuries can kill, far from being an apocalyptic fantasy, is instead a very real possibility for the 21st century.”

The growth of antibiotic-resistant pathogens means that in ever more cases, standard treatments no longer work, infections are harder or impossible to control, the risk of spreading infections to others is increased, and illnesses and hospital stays are prolonged. All of these drive up the costs of illnesses and the risk of death. The survey sought to determine the scope of the problem by asking countries to submit their most recent surveillance data (114 did so). Unfortunately, the data was glaringly incomplete because few countries track and monitor antibiotic resistance comprehensively, and there is no standard methodology for doing so.

Still, it is clear that major resistance problems have already developed, both for antibiotics that are used routinely and for those deemed “last resort” treatments to cure people when all else has failed. Carbapenem antibiotics, a class of drugs used as a last resort to treat life-threatening infections caused by a common intestinal bacterium, have failed to work in more than half the people treated in some countries. The bacterium is a major cause of hospital-acquired infections such as pneumonia, bloodstream infections, and infections in newborns and intensive-care patients. Similarly, the failure of a last-resort treatment for gonorrhoea has been confirmed in 10 countries, including many with advanced health care systems, such as Australia, Canada, France, Sweden and Britain. And resistance to a class of antibiotics that is routinely used to treat urinary tract infections caused by E. coli is widespread; in some countries the drugs are now ineffective in more than half of the patients treated. This sobering report is intended to kick-start a global campaign to develop tools and standards to track drug resistance, measure its health and economic impact, and design solutions.

The most urgent need is to minimize the overuse of antibiotics in medicine and agriculture, which accelerates the development of resistant strains. In the United States, the Food and Drug Administration (FDA) has issued voluntary guidelines calling on drug companies, animal producers and veterinarians to stop indiscriminately using antibiotics that are important for treating humans on livestock; the drug companies have said they will comply. But the agency, shortsightedly, has appealed a court order requiring it to ban the use of penicillin and two forms of tetracycline by animal producers to promote growth unless they provide proof that it will not promote drug-resistant microbes.

The pharmaceutical industry needs to be encouraged to develop new antibiotics to supplement those that are losing their effectiveness. The Royal Pharmaceutical Society, which represents pharmacists in Britain, called this month for stronger financial incentives. It said that no new class of antibiotics has been discovered since 1987, largely because the financial returns for finding new classes of antibiotics are too low. Unlike lucrative drugs to treat chronic diseases like cancer and cardiovascular ailments, antibiotics are typically taken for a short period of time, and any new drug is apt to be used sparingly and held in reserve to treat patients resistant to existing drugs. Antibiotics have transformed medicine and saved countless lives over the past seven decades. Now, rampant overuse and the lack of new drugs in the pipeline threaten to undermine their effectiveness.

(www.nytimes.com. Adaptado.)

According to the fourth paragraph of the text, the - UNIFESP 2015

Inglês - 2015Leia o texto para responder a questão.

The Rise of Antibiotic Resistance

By The Editorial Board

May 10, 2014

The World Health Organization has surveyed the growth of antibiotic-resistant germs around the world – the first such survey it has ever conducted – and come up with disturbing findings. In a report issued late last month, the organization found that antimicrobial resistance in bacteria (the main focus of the report), fungi, viruses and parasites is an increasingly serious threat in every part of the world. “A problem so serious that it threatens the achievements of modern medicine,” the organization said. “A post-antibiotic era, in which common infections and minor injuries can kill, far from being an apocalyptic fantasy, is instead a very real possibility for the 21st century.”

The growth of antibiotic-resistant pathogens means that in ever more cases, standard treatments no longer work, infections are harder or impossible to control, the risk of spreading infections to others is increased, and illnesses and hospital stays are prolonged. All of these drive up the costs of illnesses and the risk of death. The survey sought to determine the scope of the problem by asking countries to submit their most recent surveillance data (114 did so). Unfortunately, the data was glaringly incomplete because few countries track and monitor antibiotic resistance comprehensively, and there is no standard methodology for doing so.

Still, it is clear that major resistance problems have already developed, both for antibiotics that are used routinely and for those deemed “last resort” treatments to cure people when all else has failed. Carbapenem antibiotics, a class of drugs used as a last resort to treat life-threatening infections caused by a common intestinal bacterium, have failed to work in more than half the people treated in some countries. The bacterium is a major cause of hospital-acquired infections such as pneumonia, bloodstream infections, and infections in newborns and intensive-care patients. Similarly, the failure of a last-resort treatment for gonorrhoea has been confirmed in 10 countries, including many with advanced health care systems, such as Australia, Canada, France, Sweden and Britain. And resistance to a class of antibiotics that is routinely used to treat urinary tract infections caused by E. coli is widespread; in some countries the drugs are now ineffective in more than half of the patients treated. This sobering report is intended to kick-start a global campaign to develop tools and standards to track drug resistance, measure its health and economic impact, and design solutions.

The most urgent need is to minimize the overuse of antibiotics in medicine and agriculture, which accelerates the development of resistant strains. In the United States, the Food and Drug Administration (FDA) has issued voluntary guidelines calling on drug companies, animal producers and veterinarians to stop indiscriminately using antibiotics that are important for treating humans on livestock; the drug companies have said they will comply. But the agency, shortsightedly, has appealed a court order requiring it to ban the use of penicillin and two forms of tetracycline by animal producers to promote growth unless they provide proof that it will not promote drug-resistant microbes.

The pharmaceutical industry needs to be encouraged to develop new antibiotics to supplement those that are losing their effectiveness. The Royal Pharmaceutical Society, which represents pharmacists in Britain, called this month for stronger financial incentives. It said that no new class of antibiotics has been discovered since 1987, largely because the financial returns for finding new classes of antibiotics are too low. Unlike lucrative drugs to treat chronic diseases like cancer and cardiovascular ailments, antibiotics are typically taken for a short period of time, and any new drug is apt to be used sparingly and held in reserve to treat patients resistant to existing drugs. Antibiotics have transformed medicine and saved countless lives over the past seven decades. Now, rampant overuse and the lack of new drugs in the pipeline threaten to undermine their effectiveness.

(www.nytimes.com. Adaptado.)

According to the text, last resort antibiotics a) have - UNIFESP 2015

Inglês - 2015Leia o texto para responder a questão.

The Rise of Antibiotic Resistance

By The Editorial Board

May 10, 2014

The World Health Organization has surveyed the growth of antibiotic-resistant germs around the world – the first such survey it has ever conducted – and come up with disturbing findings. In a report issued late last month, the organization found that antimicrobial resistance in bacteria (the main focus of the report), fungi, viruses and parasites is an increasingly serious threat in every part of the world. “A problem so serious that it threatens the achievements of modern medicine,” the organization said. “A post-antibiotic era, in which common infections and minor injuries can kill, far from being an apocalyptic fantasy, is instead a very real possibility for the 21st century.”

The growth of antibiotic-resistant pathogens means that in ever more cases, standard treatments no longer work, infections are harder or impossible to control, the risk of spreading infections to others is increased, and illnesses and hospital stays are prolonged. All of these drive up the costs of illnesses and the risk of death. The survey sought to determine the scope of the problem by asking countries to submit their most recent surveillance data (114 did so). Unfortunately, the data was glaringly incomplete because few countries track and monitor antibiotic resistance comprehensively, and there is no standard methodology for doing so.

Still, it is clear that major resistance problems have already developed, both for antibiotics that are used routinely and for those deemed “last resort” treatments to cure people when all else has failed. Carbapenem antibiotics, a class of drugs used as a last resort to treat life-threatening infections caused by a common intestinal bacterium, have failed to work in more than half the people treated in some countries. The bacterium is a major cause of hospital-acquired infections such as pneumonia, bloodstream infections, and infections in newborns and intensive-care patients. Similarly, the failure of a last-resort treatment for gonorrhoea has been confirmed in 10 countries, including many with advanced health care systems, such as Australia, Canada, France, Sweden and Britain. And resistance to a class of antibiotics that is routinely used to treat urinary tract infections caused by E. coli is widespread; in some countries the drugs are now ineffective in more than half of the patients treated. This sobering report is intended to kick-start a global campaign to develop tools and standards to track drug resistance, measure its health and economic impact, and design solutions.

The most urgent need is to minimize the overuse of antibiotics in medicine and agriculture, which accelerates the development of resistant strains. In the United States, the Food and Drug Administration (FDA) has issued voluntary guidelines calling on drug companies, animal producers and veterinarians to stop indiscriminately using antibiotics that are important for treating humans on livestock; the drug companies have said they will comply. But the agency, shortsightedly, has appealed a court order requiring it to ban the use of penicillin and two forms of tetracycline by animal producers to promote growth unless they provide proof that it will not promote drug-resistant microbes.

The pharmaceutical industry needs to be encouraged to develop new antibiotics to supplement those that are losing their effectiveness. The Royal Pharmaceutical Society, which represents pharmacists in Britain, called this month for stronger financial incentives. It said that no new class of antibiotics has been discovered since 1987, largely because the financial returns for finding new classes of antibiotics are too low. Unlike lucrative drugs to treat chronic diseases like cancer and cardiovascular ailments, antibiotics are typically taken for a short period of time, and any new drug is apt to be used sparingly and held in reserve to treat patients resistant to existing drugs. Antibiotics have transformed medicine and saved countless lives over the past seven decades. Now, rampant overuse and the lack of new drugs in the pipeline threaten to undermine their effectiveness.

(www.nytimes.com. Adaptado.)

Segundo o texto, o relatório da Organização Mundial da - UNIFESP 2015

Inglês - 2015Leia o texto para responder a questão.

The Rise of Antibiotic Resistance

By The Editorial Board

May 10, 2014

The World Health Organization has surveyed the growth of antibiotic-resistant germs around the world – the first such survey it has ever conducted – and come up with disturbing findings. In a report issued late last month, the organization found that antimicrobial resistance in bacteria (the main focus of the report), fungi, viruses and parasites is an increasingly serious threat in every part of the world. “A problem so serious that it threatens the achievements of modern medicine,” the organization said. “A post-antibiotic era, in which common infections and minor injuries can kill, far from being an apocalyptic fantasy, is instead a very real possibility for the 21st century.”

The growth of antibiotic-resistant pathogens means that in ever more cases, standard treatments no longer work, infections are harder or impossible to control, the risk of spreading infections to others is increased, and illnesses and hospital stays are prolonged. All of these drive up the costs of illnesses and the risk of death. The survey sought to determine the scope of the problem by asking countries to submit their most recent surveillance data (114 did so). Unfortunately, the data was glaringly incomplete because few countries track and monitor antibiotic resistance comprehensively, and there is no standard methodology for doing so.

Still, it is clear that major resistance problems have already developed, both for antibiotics that are used routinely and for those deemed “last resort” treatments to cure people when all else has failed. Carbapenem antibiotics, a class of drugs used as a last resort to treat life-threatening infections caused by a common intestinal bacterium, have failed to work in more than half the people treated in some countries. The bacterium is a major cause of hospital-acquired infections such as pneumonia, bloodstream infections, and infections in newborns and intensive-care patients. Similarly, the failure of a last-resort treatment for gonorrhoea has been confirmed in 10 countries, including many with advanced health care systems, such as Australia, Canada, France, Sweden and Britain. And resistance to a class of antibiotics that is routinely used to treat urinary tract infections caused by E. coli is widespread; in some countries the drugs are now ineffective in more than half of the patients treated. This sobering report is intended to kick-start a global campaign to develop tools and standards to track drug resistance, measure its health and economic impact, and design solutions.

The most urgent need is to minimize the overuse of antibiotics in medicine and agriculture, which accelerates the development of resistant strains. In the United States, the Food and Drug Administration (FDA) has issued voluntary guidelines calling on drug companies, animal producers and veterinarians to stop indiscriminately using antibiotics that are important for treating humans on livestock; the drug companies have said they will comply. But the agency, shortsightedly, has appealed a court order requiring it to ban the use of penicillin and two forms of tetracycline by animal producers to promote growth unless they provide proof that it will not promote drug-resistant microbes.

The pharmaceutical industry needs to be encouraged to develop new antibiotics to supplement those that are losing their effectiveness. The Royal Pharmaceutical Society, which represents pharmacists in Britain, called this month for stronger financial incentives. It said that no new class of antibiotics has been discovered since 1987, largely because the financial returns for finding new classes of antibiotics are too low. Unlike lucrative drugs to treat chronic diseases like cancer and cardiovascular ailments, antibiotics are typically taken for a short period of time, and any new drug is apt to be used sparingly and held in reserve to treat patients resistant to existing drugs. Antibiotics have transformed medicine and saved countless lives over the past seven decades. Now, rampant overuse and the lack of new drugs in the pipeline threaten to undermine their effectiveness.

(www.nytimes.com. Adaptado.)

Segundo o texto, um dos objetivos do relatório da - UNIFESP 2015

Inglês - 2015Leia o texto para responder a questão.

The Rise of Antibiotic Resistance

By The Editorial Board

May 10, 2014

The World Health Organization has surveyed the growth of antibiotic-resistant germs around the world – the first such survey it has ever conducted – and come up with disturbing findings. In a report issued late last month, the organization found that antimicrobial resistance in bacteria (the main focus of the report), fungi, viruses and parasites is an increasingly serious threat in every part of the world. “A problem so serious that it threatens the achievements of modern medicine,” the organization said. “A post-antibiotic era, in which common infections and minor injuries can kill, far from being an apocalyptic fantasy, is instead a very real possibility for the 21st century.”

The growth of antibiotic-resistant pathogens means that in ever more cases, standard treatments no longer work, infections are harder or impossible to control, the risk of spreading infections to others is increased, and illnesses and hospital stays are prolonged. All of these drive up the costs of illnesses and the risk of death. The survey sought to determine the scope of the problem by asking countries to submit their most recent surveillance data (114 did so). Unfortunately, the data was glaringly incomplete because few countries track and monitor antibiotic resistance comprehensively, and there is no standard methodology for doing so.

Still, it is clear that major resistance problems have already developed, both for antibiotics that are used routinely and for those deemed “last resort” treatments to cure people when all else has failed. Carbapenem antibiotics, a class of drugs used as a last resort to treat life-threatening infections caused by a common intestinal bacterium, have failed to work in more than half the people treated in some countries. The bacterium is a major cause of hospital-acquired infections such as pneumonia, bloodstream infections, and infections in newborns and intensive-care patients. Similarly, the failure of a last-resort treatment for gonorrhoea has been confirmed in 10 countries, including many with advanced health care systems, such as Australia, Canada, France, Sweden and Britain. And resistance to a class of antibiotics that is routinely used to treat urinary tract infections caused by E. coli is widespread; in some countries the drugs are now ineffective in more than half of the patients treated. This sobering report is intended to kick-start a global campaign to develop tools and standards to track drug resistance, measure its health and economic impact, and design solutions.

The most urgent need is to minimize the overuse of antibiotics in medicine and agriculture, which accelerates the development of resistant strains. In the United States, the Food and Drug Administration (FDA) has issued voluntary guidelines calling on drug companies, animal producers and veterinarians to stop indiscriminately using antibiotics that are important for treating humans on livestock; the drug companies have said they will comply. But the agency, shortsightedly, has appealed a court order requiring it to ban the use of penicillin and two forms of tetracycline by animal producers to promote growth unless they provide proof that it will not promote drug-resistant microbes.

The pharmaceutical industry needs to be encouraged to develop new antibiotics to supplement those that are losing their effectiveness. The Royal Pharmaceutical Society, which represents pharmacists in Britain, called this month for stronger financial incentives. It said that no new class of antibiotics has been discovered since 1987, largely because the financial returns for finding new classes of antibiotics are too low. Unlike lucrative drugs to treat chronic diseases like cancer and cardiovascular ailments, antibiotics are typically taken for a short period of time, and any new drug is apt to be used sparingly and held in reserve to treat patients resistant to existing drugs. Antibiotics have transformed medicine and saved countless lives over the past seven decades. Now, rampant overuse and the lack of new drugs in the pipeline threaten to undermine their effectiveness.

(www.nytimes.com. Adaptado.)

No trecho do quarto parágrafo “Rather, he is keen to - UNIFESP 2015

Inglês - 2015Leia o texto para responder a questão.

Every new piece of information about Britain’s weight problem makes for ever more depressing reading. Duncan Selbie, the Chief Executive of Public Health England, today tells us that by 2034 some six million Britons will suffer from diabetes. Of course, many people develop diabetes through no fault of their own. But Mr Selbie’s research concludes that if the levels of obesity returned to their 1994 levels, 1.7 million fewer people would suffer from the condition.

Given that fighting diabetes already drains the National Health Service (NHS) by more than £1.5 million, or 10 per cent of its budget for England, the impact upon the Treasury in 20 years’ time from unhealthy lifestyles could be catastrophic. Bad health not only impacts on the individual but also on the rest of the community. Diagnosis of the challenge is straightforward. The tougher question is what to do about reducing waistlines in a country where we traditionally do not like telling individuals what to do.

It is interesting to note that Mr Selbie does not ascribe to the Big Brother approach of ceaseless legislation and nannying. Rather, he is keen to promote choices – making the case passionately that people should be encouraged to embrace good health. One of his suggestions is that parents feed their children from smaller plates. That way the child can clear his or her plate, as ordered, without actually consuming too much. Like all good ideas, this is rooted in common sense.

(www.telegraph.co.uk. Adaptado.)

No trecho do segundo parágrafo “Bad health not only - UNIFESP 2015

Inglês - 2015Leia o texto para responder a questão.

Every new piece of information about Britain’s weight problem makes for ever more depressing reading. Duncan Selbie, the Chief Executive of Public Health England, today tells us that by 2034 some six million Britons will suffer from diabetes. Of course, many people develop diabetes through no fault of their own. But Mr Selbie’s research concludes that if the levels of obesity returned to their 1994 levels, 1.7 million fewer people would suffer from the condition.

Given that fighting diabetes already drains the National Health Service (NHS) by more than £1.5 million, or 10 per cent of its budget for England, the impact upon the Treasury in 20 years’ time from unhealthy lifestyles could be catastrophic. Bad health not only impacts on the individual but also on the rest of the community. Diagnosis of the challenge is straightforward. The tougher question is what to do about reducing waistlines in a country where we traditionally do not like telling individuals what to do.

It is interesting to note that Mr Selbie does not ascribe to the Big Brother approach of ceaseless legislation and nannying. Rather, he is keen to promote choices – making the case passionately that people should be encouraged to embrace good health. One of his suggestions is that parents feed their children from smaller plates. That way the child can clear his or her plate, as ordered, without actually consuming too much. Like all good ideas, this is rooted in common sense.

(www.telegraph.co.uk. Adaptado.)

No trecho inicial do segundo parágrafo “Given that figh - UNIFESP 2015

Língua Portuguesa - 2015Leia o texto para responder a questão.

Every new piece of information about Britain’s weight problem makes for ever more depressing reading. Duncan Selbie, the Chief Executive of Public Health England, today tells us that by 2034 some six million Britons will suffer from diabetes. Of course, many people develop diabetes through no fault of their own. But Mr Selbie’s research concludes that if the levels of obesity returned to their 1994 levels, 1.7 million fewer people would suffer from the condition.

Given that fighting diabetes already drains the National Health Service (NHS) by more than £1.5 million, or 10 per cent of its budget for England, the impact upon the Treasury in 20 years’ time from unhealthy lifestyles could be catastrophic. Bad health not only impacts on the individual but also on the rest of the community. Diagnosis of the challenge is straightforward. The tougher question is what to do about reducing waistlines in a country where we traditionally do not like telling individuals what to do.

It is interesting to note that Mr Selbie does not ascribe to the Big Brother approach of ceaseless legislation and nannying. Rather, he is keen to promote choices – making the case passionately that people should be encouraged to embrace good health. One of his suggestions is that parents feed their children from smaller plates. That way the child can clear his or her plate, as ordered, without actually consuming too much. Like all good ideas, this is rooted in common sense.

(www.telegraph.co.uk. Adaptado.)

Segundo o texto, a diabetes a) deve ter suas causas - UNIFESP 2015

Inglês - 2015Leia o texto para responder a questão.

Every new piece of information about Britain’s weight problem makes for ever more depressing reading. Duncan Selbie, the Chief Executive of Public Health England, today tells us that by 2034 some six million Britons will suffer from diabetes. Of course, many people develop diabetes through no fault of their own. But Mr Selbie’s research concludes that if the levels of obesity returned to their 1994 levels, 1.7 million fewer people would suffer from the condition.

Given that fighting diabetes already drains the National Health Service (NHS) by more than £1.5 million, or 10 per cent of its budget for England, the impact upon the Treasury in 20 years’ time from unhealthy lifestyles could be catastrophic. Bad health not only impacts on the individual but also on the rest of the community. Diagnosis of the challenge is straightforward. The tougher question is what to do about reducing waistlines in a country where we traditionally do not like telling individuals what to do.

It is interesting to note that Mr Selbie does not ascribe to the Big Brother approach of ceaseless legislation and nannying. Rather, he is keen to promote choices – making the case passionately that people should be encouraged to embrace good health. One of his suggestions is that parents feed their children from smaller plates. That way the child can clear his or her plate, as ordered, without actually consuming too much. Like all good ideas, this is rooted in common sense.

(www.telegraph.co.uk. Adaptado.)

The excerpt from the first paragraph “many people - UNIFESP 2015

Inglês - 2015Leia o texto para responder a questão.

Every new piece of information about Britain’s weight problem makes for ever more depressing reading. Duncan Selbie, the Chief Executive of Public Health England, today tells us that by 2034 some six million Britons will suffer from diabetes. Of course, many people develop diabetes through no fault of their own. But Mr Selbie’s research concludes that if the levels of obesity returned to their 1994 levels, 1.7 million fewer people would suffer from the condition.

Given that fighting diabetes already drains the National Health Service (NHS) by more than £1.5 million, or 10 per cent of its budget for England, the impact upon the Treasury in 20 years’ time from unhealthy lifestyles could be catastrophic. Bad health not only impacts on the individual but also on the rest of the community. Diagnosis of the challenge is straightforward. The tougher question is what to do about reducing waistlines in a country where we traditionally do not like telling individuals what to do.

It is interesting to note that Mr Selbie does not ascribe to the Big Brother approach of ceaseless legislation and nannying. Rather, he is keen to promote choices – making the case passionately that people should be encouraged to embrace good health. One of his suggestions is that parents feed their children from smaller plates. That way the child can clear his or her plate, as ordered, without actually consuming too much. Like all good ideas, this is rooted in common sense.

(www.telegraph.co.uk. Adaptado.)

According to the text, Mr Duncan Selbie concluded that - UNIFESP 2015

Inglês - 2015Leia o texto para responder a questão.

Every new piece of information about Britain’s weight problem makes for ever more depressing reading. Duncan Selbie, the Chief Executive of Public Health England, today tells us that by 2034 some six million Britons will suffer from diabetes. Of course, many people develop diabetes through no fault of their own. But Mr Selbie’s research concludes that if the levels of obesity returned to their 1994 levels, 1.7 million fewer people would suffer from the condition.

Given that fighting diabetes already drains the National Health Service (NHS) by more than £1.5 million, or 10 per cent of its budget for England, the impact upon the Treasury in 20 years’ time from unhealthy lifestyles could be catastrophic. Bad health not only impacts on the individual but also on the rest of the community. Diagnosis of the challenge is straightforward. The tougher question is what to do about reducing waistlines in a country where we traditionally do not like telling individuals what to do.

It is interesting to note that Mr Selbie does not ascribe to the Big Brother approach of ceaseless legislation and nannying. Rather, he is keen to promote choices – making the case passionately that people should be encouraged to embrace good health. One of his suggestions is that parents feed their children from smaller plates. That way the child can clear his or her plate, as ordered, without actually consuming too much. Like all good ideas, this is rooted in common sense.

(www.telegraph.co.uk. Adaptado.)

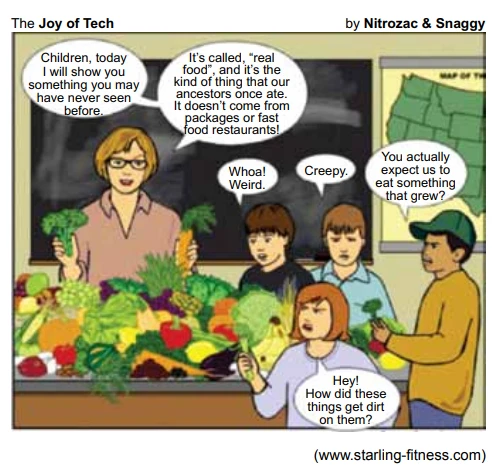

When introduced to “real food” the children express a) - UNIFESP 2015

Língua Portuguesa - 2015Explique em no máximo 3 parágrafos o por que a resposta para a pergunta abaixo é a alternativa B) Examine o quadrinho para responder a questão.

O quadrinho faz uma crítica a) à falta de bons modos - UNIFESP 2015

Inglês - 2015Examine o quadrinho para responder a questão.

A análise do soneto revela como tema e recursos poético - UNIFESP 2015

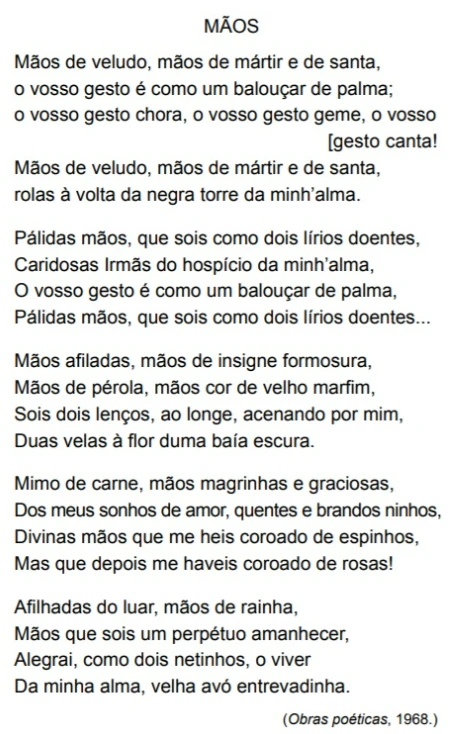

Língua Portuguesa - 2015Leia o soneto de Cruz e Sousa.

Silêncios

“Largos Silêncios interpretativos,

Adoçados por funda nostalgia,

Balada de consolo e simpatia

Que os sentimentos meus torna cativos;

Harmonia de doces lenitivos,

Sombra, segredo, lágrima, harmonia

Da alma serena, da alma fugidia

Nos seus vagos espasmos sugestivos.

Ó Silêncios! ó cândidos desmaios,

Vácuos fecundos de celestes raios

De sonhos, no mais límpido cortejo...

Eu vos sinto os mistérios insondáveis

Como de estranhos anjos inefáveis

O glorioso esplendor de um grande beijo!

Assinale a alternativa que apresenta uma correta - UNIFESP 2015

Língua Portuguesa - 2015Leia o trecho do conto “O mandarim”, de Eça de Queirós, para responder a questão.

Então começou a minha vida de milionário. Deixei bem depressa a casa de Madame Marques – que, desde que me sabia rico, me tratava todos os dias a arroz-doce, e ela mesma me servia, com o seu vestido de seda dos domingos. Comprei, habitei o palacete amarelo, ao Loreto: as magnificências da minha instalação são bem conhecidas pelas gravuras indiscretas da Ilustração Francesa. Tornou-se famoso na Europa o meu leito, de um gosto exuberante e bárbaro, com a barra recoberta de lâminas de ouro lavrado e cortinados de um raro brocado negro onde ondeiam, bordados a pérolas, versos eróticos de Catulo; uma lâmpada, suspensa no interior, derrama ali a claridade láctea e amorosa de um luar de Verão.

[...]

Entretanto Lisboa rojava-se aos meus pés. O pátio do palacete estava constantemente invadido por uma turba: olhando-a enfastiado das janelas da galeria, eu via lá branquejar os peitilhos da Aristocracia, negrejar a sotaina do Clero, e luzir o suor da Plebe: todos vinham suplicar, de lábio abjeto, a honra do meu sorriso e uma participação no meu ouro. Às vezes consentia em receber algum velho de título histórico: – ele adiantava-se pela sala, quase roçando o tapete com os cabelos brancos, tartamudeando adulações; e imediatamente, espalmando sobre o peito a mão de fortes veias onde corria um sangue de três séculos, oferecia-me uma filha bem-amada para esposa ou para concubina.

Todos os cidadãos me traziam presentes como a um ídolo sobre o altar – uns odes votivas, outros o meu monograma bordado a cabelo, alguns chinelas ou boquilhas, cada um a sua consciência. Se o meu olhar amortecido fixava, por acaso, na rua, uma mulher – era logo ao outro dia uma carta em que a criatura, esposa ou prostituta, me ofertava a sua nudez, o seu amor, e todas as complacências da lascívia.

Os jornalistas esporeavam a imaginação para achar adjetivos dignos da minha grandeza; fui o sublime Sr. Teodoro, cheguei a ser o celeste Sr. Teodoro; então, desvairada, a Gazeta das Locais chamou-me o extraceleste Sr. Teodoro! Diante de mim nenhuma cabeça ficou jamais coberta – ou usasse a coroa ou o coco. Todos os dias me era oferecida uma presidência de Ministério ou uma direção de confraria. Recusei sempre, com nojo.

(Eça de Queirós. O mandarim, s/d.)

“Os jornalistas esporeavam a imaginação para achar - UNIFESP 2015

Língua Portuguesa - 2015Leia o trecho do conto “O mandarim”, de Eça de Queirós, para responder a questão.

Então começou a minha vida de milionário. Deixei bem depressa a casa de Madame Marques – que, desde que me sabia rico, me tratava todos os dias a arroz-doce, e ela mesma me servia, com o seu vestido de seda dos domingos. Comprei, habitei o palacete amarelo, ao Loreto: as magnificências da minha instalação são bem conhecidas pelas gravuras indiscretas da Ilustração Francesa. Tornou-se famoso na Europa o meu leito, de um gosto exuberante e bárbaro, com a barra recoberta de lâminas de ouro lavrado e cortinados de um raro brocado negro onde ondeiam, bordados a pérolas, versos eróticos de Catulo; uma lâmpada, suspensa no interior, derrama ali a claridade láctea e amorosa de um luar de Verão.

[...]

Entretanto Lisboa rojava-se aos meus pés. O pátio do palacete estava constantemente invadido por uma turba: olhando-a enfastiado das janelas da galeria, eu via lá branquejar os peitilhos da Aristocracia, negrejar a sotaina do Clero, e luzir o suor da Plebe: todos vinham suplicar, de lábio abjeto, a honra do meu sorriso e uma participação no meu ouro. Às vezes consentia em receber algum velho de título histórico: – ele adiantava-se pela sala, quase roçando o tapete com os cabelos brancos, tartamudeando adulações; e imediatamente, espalmando sobre o peito a mão de fortes veias onde corria um sangue de três séculos, oferecia-me uma filha bem-amada para esposa ou para concubina.

Todos os cidadãos me traziam presentes como a um ídolo sobre o altar – uns odes votivas, outros o meu monograma bordado a cabelo, alguns chinelas ou boquilhas, cada um a sua consciência. Se o meu olhar amortecido fixava, por acaso, na rua, uma mulher – era logo ao outro dia uma carta em que a criatura, esposa ou prostituta, me ofertava a sua nudez, o seu amor, e todas as complacências da lascívia.

Os jornalistas esporeavam a imaginação para achar adjetivos dignos da minha grandeza; fui o sublime Sr. Teodoro, cheguei a ser o celeste Sr. Teodoro; então, desvairada, a Gazeta das Locais chamou-me o extraceleste Sr. Teodoro! Diante de mim nenhuma cabeça ficou jamais coberta – ou usasse a coroa ou o coco. Todos os dias me era oferecida uma presidência de Ministério ou uma direção de confraria. Recusei sempre, com nojo.

(Eça de Queirós. O mandarim, s/d.)

Ao descrever a sua vida de milionário, o narrador a) - UNIFESP 2015

Língua Portuguesa - 2015Leia o trecho do conto “O mandarim”, de Eça de Queirós, para responder a questão.

Então começou a minha vida de milionário. Deixei bem depressa a casa de Madame Marques – que, desde que me sabia rico, me tratava todos os dias a arroz-doce, e ela mesma me servia, com o seu vestido de seda dos domingos. Comprei, habitei o palacete amarelo, ao Loreto: as magnificências da minha instalação são bem conhecidas pelas gravuras indiscretas da Ilustração Francesa. Tornou-se famoso na Europa o meu leito, de um gosto exuberante e bárbaro, com a barra recoberta de lâminas de ouro lavrado e cortinados de um raro brocado negro onde ondeiam, bordados a pérolas, versos eróticos de Catulo; uma lâmpada, suspensa no interior, derrama ali a claridade láctea e amorosa de um luar de Verão.

[...]

Entretanto Lisboa rojava-se aos meus pés. O pátio do palacete estava constantemente invadido por uma turba: olhando-a enfastiado das janelas da galeria, eu via lá branquejar os peitilhos da Aristocracia, negrejar a sotaina do Clero, e luzir o suor da Plebe: todos vinham suplicar, de lábio abjeto, a honra do meu sorriso e uma participação no meu ouro. Às vezes consentia em receber algum velho de título histórico: – ele adiantava-se pela sala, quase roçando o tapete com os cabelos brancos, tartamudeando adulações; e imediatamente, espalmando sobre o peito a mão de fortes veias onde corria um sangue de três séculos, oferecia-me uma filha bem-amada para esposa ou para concubina.

Todos os cidadãos me traziam presentes como a um ídolo sobre o altar – uns odes votivas, outros o meu monograma bordado a cabelo, alguns chinelas ou boquilhas, cada um a sua consciência. Se o meu olhar amortecido fixava, por acaso, na rua, uma mulher – era logo ao outro dia uma carta em que a criatura, esposa ou prostituta, me ofertava a sua nudez, o seu amor, e todas as complacências da lascívia.

Os jornalistas esporeavam a imaginação para achar adjetivos dignos da minha grandeza; fui o sublime Sr. Teodoro, cheguei a ser o celeste Sr. Teodoro; então, desvairada, a Gazeta das Locais chamou-me o extraceleste Sr. Teodoro! Diante de mim nenhuma cabeça ficou jamais coberta – ou usasse a coroa ou o coco. Todos os dias me era oferecida uma presidência de Ministério ou uma direção de confraria. Recusei sempre, com nojo.

(Eça de Queirós. O mandarim, s/d.)

“A pessoa é presa por pirataria – e aí a cadeia mostra - UNIFESP 2015

Língua Portuguesa - 2015“A pessoa é presa por pirataria – e aí a cadeia mostra filmes piratas?”, denunciou o americano Richard Humprey, condenado a 29 meses de prisão por distribuir conteúdo pirateado na internet. O presídio onde ele está, em Ohio, foi pego exibindo uma cópia ilegal do filme O lobo de Wall Street.

O crítico Massaud Moisés assinala o filosofismo como - UNIFESP 2015

Língua Portuguesa - 2015O crítico Massaud Moisés assinala o filosofismo como uma das características de Memórias póstumas de Brás Cubas, romance que inaugura a produção madura de Machado de Assis.

Examine a passagem do texto 2: “e eventualmente se - UNIFESP 2015

Língua Portuguesa - 2015Para responder a questão, leia as opiniões em relação ao projeto de adaptação que visa facilitar obras de Machado de Assis.

Texto 1

Isso é um assassinato e eu endosso. A autora [da adaptação] quer que a Academia se manifeste. Para ela, vai ser a glória. Mas vários acadêmicos se manifestaram. Eu me manifestei. Há temas em que a instituição não pode se baratear. Essa mulher quer que nós tenhamos essa discussão como se ela estivesse propondo a ressurreição eterna de Machado de Assis, como se ele dependesse dela. Confio na vigilância da sociedade. Vamos para a rua protestar.

(Nélida Piñon. http://entretenimento.uol.com.br)

Texto 2

É melhor que o sujeito comece a ler através de uma adaptação bem feita de um clássico do que seja obrigado a ler um texto ilegível e incompreensível segundo a linguagem e os parâmetros culturais atuais. Depois que leu a adaptação, ele pode pegar o gosto, entrar no processo de leitura e eventualmente se interessar por ler o Machadão no original. Agora, dar uma machadada em um moleque que tem PS3, Xbox, 1000 canais a cabo e toda a internet à disposição é simplesmente burrice.

(Ronaldo Bressane. http://entretenimento.uol.com.br)

Texto 3

Não defenderia, jamais, que Secco [autora da adaptação] fosse impedida de realizar seu projeto, mas não me parece que a proposta devesse merecer apoio do Ministério da Cultura e ser realizada com a ajuda de leis que, afinal, transferem impostos para a cultura. Trata-se, na melhor das hipóteses, de ingenuidade; na pior, de excesso de “sagacidade”. Não será a adulteração de obras, para torná-las supostamente mais legíveis por ignorantes, que irá resolver o problema do acesso a textos literários históricos – mesmo porque, adulterados, já terão deixado de ser o que eram.

(Marcos Augusto Gonçalves. http://www.folha.uol.com.br)

Examine os enunciados: • “Vamos para a rua protestar.” - UNIFESP 2015

Língua Portuguesa - 2015Para responder a questão, leia as opiniões em relação ao projeto de adaptação que visa facilitar obras de Machado de Assis.

Texto 1

Isso é um assassinato e eu endosso. A autora [da adaptação] quer que a Academia se manifeste. Para ela, vai ser a glória. Mas vários acadêmicos se manifestaram. Eu me manifestei. Há temas em que a instituição não pode se baratear. Essa mulher quer que nós tenhamos essa discussão como se ela estivesse propondo a ressurreição eterna de Machado de Assis, como se ele dependesse dela. Confio na vigilância da sociedade. Vamos para a rua protestar.

(Nélida Piñon. http://entretenimento.uol.com.br)

Texto 2

É melhor que o sujeito comece a ler através de uma adaptação bem feita de um clássico do que seja obrigado a ler um texto ilegível e incompreensível segundo a linguagem e os parâmetros culturais atuais. Depois que leu a adaptação, ele pode pegar o gosto, entrar no processo de leitura e eventualmente se interessar por ler o Machadão no original. Agora, dar uma machadada em um moleque que tem PS3, Xbox, 1000 canais a cabo e toda a internet à disposição é simplesmente burrice.

(Ronaldo Bressane. http://entretenimento.uol.com.br)

Texto 3

Não defenderia, jamais, que Secco [autora da adaptação] fosse impedida de realizar seu projeto, mas não me parece que a proposta devesse merecer apoio do Ministério da Cultura e ser realizada com a ajuda de leis que, afinal, transferem impostos para a cultura. Trata-se, na melhor das hipóteses, de ingenuidade; na pior, de excesso de “sagacidade”. Não será a adulteração de obras, para torná-las supostamente mais legíveis por ignorantes, que irá resolver o problema do acesso a textos literários históricos – mesmo porque, adulterados, já terão deixado de ser o que eram.

(Marcos Augusto Gonçalves. http://www.folha.uol.com.br)

Examine os enunciados:

• “Vamos para a rua protestar.” (Texto 1)

• “Não será a adulteração de obras, para torná-las supostamente mais legíveis por ignorantes” (Texto 3)

Em relação à questão da facilitação das obras macha - UNIFESP 2015

Língua Portuguesa - 2015Para responder a questão, leia as opiniões em relação ao projeto de adaptação que visa facilitar obras de Machado de Assis.

Texto 1

Isso é um assassinato e eu endosso. A autora [da adaptação] quer que a Academia se manifeste. Para ela, vai ser a glória. Mas vários acadêmicos se manifestaram. Eu me manifestei. Há temas em que a instituição não pode se baratear. Essa mulher quer que nós tenhamos essa discussão como se ela estivesse propondo a ressurreição eterna de Machado de Assis, como se ele dependesse dela. Confio na vigilância da sociedade. Vamos para a rua protestar.

(Nélida Piñon. http://entretenimento.uol.com.br)

Texto 2

É melhor que o sujeito comece a ler através de uma adaptação bem feita de um clássico do que seja obrigado a ler um texto ilegível e incompreensível segundo a linguagem e os parâmetros culturais atuais. Depois que leu a adaptação, ele pode pegar o gosto, entrar no processo de leitura e eventualmente se interessar por ler o Machadão no original. Agora, dar uma machadada em um moleque que tem PS3, Xbox, 1000 canais a cabo e toda a internet à disposição é simplesmente burrice.

(Ronaldo Bressane. http://entretenimento.uol.com.br)

Texto 3

Não defenderia, jamais, que Secco [autora da adaptação] fosse impedida de realizar seu projeto, mas não me parece que a proposta devesse merecer apoio do Ministério da Cultura e ser realizada com a ajuda de leis que, afinal, transferem impostos para a cultura. Trata-se, na melhor das hipóteses, de ingenuidade; na pior, de excesso de “sagacidade”. Não será a adulteração de obras, para torná-las supostamente mais legíveis por ignorantes, que irá resolver o problema do acesso a textos literários históricos – mesmo porque, adulterados, já terão deixado de ser o que eram.

(Marcos Augusto Gonçalves. http://www.folha.uol.com.br)

Quando se quer chamar atenção para o Objeto Direto que - UNIFESP 2015

Língua Portuguesa - 2015Leia o texto para responder a questão.

Cumpridos dez anos de prisão por um crime que não pratiquei e do qual, entanto, nunca me defendi, morto para a vida e para os sonhos: nada podendo já esperar e coisa alguma desejando – eu venho fazer enfim a minha confissão: isto é, demonstrar a minha inocência.

Talvez não me acreditem. Decerto que não me acreditam. Mas pouco importa. O meu interesse hoje em gritar que não assassinei Ricardo de Loureiro é nulo. Não tenho família; não preciso que me reabilitem. Mesmo quem esteve dez anos preso, nunca se reabilita. A verdade simples é esta.

E àqueles que, lendo o que fica exposto, me perguntarem: “Mas por que não fez a sua confissão quando era tempo? Por que não demonstrou a sua inocência ao tribunal?”, a esses responderei: – A minha defesa era impossível. Ninguém me acreditaria. E fora inútil fazer-me passar por um embusteiro ou por um doido… Demais, devo confessar, após os acontecimentos em que me vira envolvido nessa época, ficara tão despedaçado que a prisão se me afigurava uma coisa sorridente. Era o esquecimento, a tranquilidade, o sono. Era um fim como qualquer outro – um termo para a minha vida devastada. Toda a minha ânsia foi pois de ver o processo terminado e começar cumprindo a minha sentença.

De resto, o meu processo foi rápido. Oh! o caso parecia bem claro… Eu nem negava nem confessava. Mas quem cala consente… E todas as simpatias estavam do meu lado.

O crime era, como devem ter dito os jornais do tempo, um “crime passional”. Cherchez la femme*. Depois, a vítima um poeta – um artista. A mulher romantizara-se desaparecendo. Eu era um herói, no fim de contas. E um herói com seus laivos de mistério, o que mais me aureolava. Por tudo isso, independentemente do belo discurso de defesa, o júri concedeu-me circunstâncias atenuantes. E a minha pena foi curta.

Ah! foi bem curta – sobretudo para mim… Esses dez anos esvoaram-se-me como dez meses. É que, em realidade, as horas não podem mais ter ação sobre aqueles que viveram um instante que focou toda a sua vida. Atingido o sofrimento máximo, nada já nos faz sofrer. Vibradas as sensações máximas, nada já nos fará oscilar. Simplesmente, este momento culminante raras são as criaturas que o vivem. As que o viveram ou são, como eu, os mortos-vivos, ou – apenas – os desencantados que, muita vez, acabam no suicídio.

* Cherchez la femme: Procurem a mulher.

(Mário de Sá-Carneiro. A confissão de Lúcio, 2011.)

Quando se quer chamar atenção para o Objeto Direto que precede o verbo, costuma-se repeti-lo. É o que se chama Objeto Direto Pleonástico, em cuja constituição entra sempre um pronome pessoal átono.

Observe as passagens do texto: • “Decerto que não me - UNIFESP 2015

Língua Portuguesa - 2015Leia o texto para responder a questão.

Cumpridos dez anos de prisão por um crime que não pratiquei e do qual, entanto, nunca me defendi, morto para a vida e para os sonhos: nada podendo já esperar e coisa alguma desejando – eu venho fazer enfim a minha confissão: isto é, demonstrar a minha inocência.

Talvez não me acreditem. Decerto que não me acreditam. Mas pouco importa. O meu interesse hoje em gritar que não assassinei Ricardo de Loureiro é nulo. Não tenho família; não preciso que me reabilitem. Mesmo quem esteve dez anos preso, nunca se reabilita. A verdade simples é esta.

E àqueles que, lendo o que fica exposto, me perguntarem: “Mas por que não fez a sua confissão quando era tempo? Por que não demonstrou a sua inocência ao tribunal?”, a esses responderei: – A minha defesa era impossível. Ninguém me acreditaria. E fora inútil fazer-me passar por um embusteiro ou por um doido… Demais, devo confessar, após os acontecimentos em que me vira envolvido nessa época, ficara tão despedaçado que a prisão se me afigurava uma coisa sorridente. Era o esquecimento, a tranquilidade, o sono. Era um fim como qualquer outro – um termo para a minha vida devastada. Toda a minha ânsia foi pois de ver o processo terminado e começar cumprindo a minha sentença.

De resto, o meu processo foi rápido. Oh! o caso parecia bem claro… Eu nem negava nem confessava. Mas quem cala consente… E todas as simpatias estavam do meu lado.

O crime era, como devem ter dito os jornais do tempo, um “crime passional”. Cherchez la femme*. Depois, a vítima um poeta – um artista. A mulher romantizara-se desaparecendo. Eu era um herói, no fim de contas. E um herói com seus laivos de mistério, o que mais me aureolava. Por tudo isso, independentemente do belo discurso de defesa, o júri concedeu-me circunstâncias atenuantes. E a minha pena foi curta.

Ah! foi bem curta – sobretudo para mim… Esses dez anos esvoaram-se-me como dez meses. É que, em realidade, as horas não podem mais ter ação sobre aqueles que viveram um instante que focou toda a sua vida. Atingido o sofrimento máximo, nada já nos faz sofrer. Vibradas as sensações máximas, nada já nos fará oscilar. Simplesmente, este momento culminante raras são as criaturas que o vivem. As que o viveram ou são, como eu, os mortos-vivos, ou – apenas – os desencantados que, muita vez, acabam no suicídio.

* Cherchez la femme: Procurem a mulher.

(Mário de Sá-Carneiro. A confissão de Lúcio, 2011.)

Observe as passagens do texto:

• “Decerto que não me acreditam.” (2.° parágrafo)

• “E um herói com seus laivos de mistério” (5.° parágrafo)

• “nada já nos fará oscilar." (6.° parágrafo)

Segundo o narrador afirma, a prisão lhe serviria para - UNIFESP 2015

Língua Portuguesa - 2015Leia o texto para responder a questão.

Cumpridos dez anos de prisão por um crime que não pratiquei e do qual, entanto, nunca me defendi, morto para a vida e para os sonhos: nada podendo já esperar e coisa alguma desejando – eu venho fazer enfim a minha confissão: isto é, demonstrar a minha inocência.

Talvez não me acreditem. Decerto que não me acreditam. Mas pouco importa. O meu interesse hoje em gritar que não assassinei Ricardo de Loureiro é nulo. Não tenho família; não preciso que me reabilitem. Mesmo quem esteve dez anos preso, nunca se reabilita. A verdade simples é esta.

E àqueles que, lendo o que fica exposto, me perguntarem: “Mas por que não fez a sua confissão quando era tempo? Por que não demonstrou a sua inocência ao tribunal?”, a esses responderei: – A minha defesa era impossível. Ninguém me acreditaria. E fora inútil fazer-me passar por um embusteiro ou por um doido… Demais, devo confessar, após os acontecimentos em que me vira envolvido nessa época, ficara tão despedaçado que a prisão se me afigurava uma coisa sorridente. Era o esquecimento, a tranquilidade, o sono. Era um fim como qualquer outro – um termo para a minha vida devastada. Toda a minha ânsia foi pois de ver o processo terminado e começar cumprindo a minha sentença.

De resto, o meu processo foi rápido. Oh! o caso parecia bem claro… Eu nem negava nem confessava. Mas quem cala consente… E todas as simpatias estavam do meu lado.

O crime era, como devem ter dito os jornais do tempo, um “crime passional”. Cherchez la femme*. Depois, a vítima um poeta – um artista. A mulher romantizara-se desaparecendo. Eu era um herói, no fim de contas. E um herói com seus laivos de mistério, o que mais me aureolava. Por tudo isso, independentemente do belo discurso de defesa, o júri concedeu-me circunstâncias atenuantes. E a minha pena foi curta.

Ah! foi bem curta – sobretudo para mim… Esses dez anos esvoaram-se-me como dez meses. É que, em realidade, as horas não podem mais ter ação sobre aqueles que viveram um instante que focou toda a sua vida. Atingido o sofrimento máximo, nada já nos faz sofrer. Vibradas as sensações máximas, nada já nos fará oscilar. Simplesmente, este momento culminante raras são as criaturas que o vivem. As que o viveram ou são, como eu, os mortos-vivos, ou – apenas – os desencantados que, muita vez, acabam no suicídio.

* Cherchez la femme: Procurem a mulher.

(Mário de Sá-Carneiro. A confissão de Lúcio, 2011.)

No texto, o narrador sugere que tinha sido condenado - UNIFESP 2015

Língua Portuguesa - 2015Leia o texto para responder a questão.

Cumpridos dez anos de prisão por um crime que não pratiquei e do qual, entanto, nunca me defendi, morto para a vida e para os sonhos: nada podendo já esperar e coisa alguma desejando – eu venho fazer enfim a minha confissão: isto é, demonstrar a minha inocência.

Talvez não me acreditem. Decerto que não me acreditam. Mas pouco importa. O meu interesse hoje em gritar que não assassinei Ricardo de Loureiro é nulo. Não tenho família; não preciso que me reabilitem. Mesmo quem esteve dez anos preso, nunca se reabilita. A verdade simples é esta.

E àqueles que, lendo o que fica exposto, me perguntarem: “Mas por que não fez a sua confissão quando era tempo? Por que não demonstrou a sua inocência ao tribunal?”, a esses responderei: – A minha defesa era impossível. Ninguém me acreditaria. E fora inútil fazer-me passar por um embusteiro ou por um doido… Demais, devo confessar, após os acontecimentos em que me vira envolvido nessa época, ficara tão despedaçado que a prisão se me afigurava uma coisa sorridente. Era o esquecimento, a tranquilidade, o sono. Era um fim como qualquer outro – um termo para a minha vida devastada. Toda a minha ânsia foi pois de ver o processo terminado e começar cumprindo a minha sentença.

De resto, o meu processo foi rápido. Oh! o caso parecia bem claro… Eu nem negava nem confessava. Mas quem cala consente… E todas as simpatias estavam do meu lado.

O crime era, como devem ter dito os jornais do tempo, um “crime passional”. Cherchez la femme*. Depois, a vítima um poeta – um artista. A mulher romantizara-se desaparecendo. Eu era um herói, no fim de contas. E um herói com seus laivos de mistério, o que mais me aureolava. Por tudo isso, independentemente do belo discurso de defesa, o júri concedeu-me circunstâncias atenuantes. E a minha pena foi curta.

Ah! foi bem curta – sobretudo para mim… Esses dez anos esvoaram-se-me como dez meses. É que, em realidade, as horas não podem mais ter ação sobre aqueles que viveram um instante que focou toda a sua vida. Atingido o sofrimento máximo, nada já nos faz sofrer. Vibradas as sensações máximas, nada já nos fará oscilar. Simplesmente, este momento culminante raras são as criaturas que o vivem. As que o viveram ou são, como eu, os mortos-vivos, ou – apenas – os desencantados que, muita vez, acabam no suicídio.

* Cherchez la femme: Procurem a mulher.

(Mário de Sá-Carneiro. A confissão de Lúcio, 2011.)

Analise a capa de um folder de uma campanha de trânsito - UNIFESP 2015

Língua Portuguesa - 2015Analise a capa de um folder de uma campanha de trânsito.

Analisando-se o emprego e a estrutura das palavras - UNIFESP 2015

Língua Portuguesa - 2015Leia o texto para responder a questão.

Você conseguiria ficar 99 dias sem o Facebook?

Uma organização não-governamental holandesa está propondo um desafio que muitos poderão considerar impossível: ficar 99 dias sem dar nem uma “olhadinha” no Facebook. O objetivo é medir o grau de felicidade dos usuários longe da rede social.

O projeto também é uma resposta aos experimentos psicológicos realizados pelo próprio Facebook. A diferença neste caso é que o teste é completamente voluntário. Ironicamente, para poder participar, o usuário deve trocar a foto do perfil no Facebook e postar um contador na rede social.

Os pesquisadores irão avaliar o grau de satisfação e felicidade dos participantes no 33º dia, no 66º e no último dia da abstinência.

Os responsáveis apontam que os usuários do Facebook gastam em média 17 minutos por dia na rede social. Em 99 dias sem acesso, a soma média seria equivalente a mais de 28 horas, que poderiam ser utilizadas em “atividades emocionalmente mais realizadoras”.

(http://codigofonte.uol.com.br. Adaptado.)

• [...] ficar 99 dias sem dar nem uma “olhadinha” no Facebook. (1.° parágrafo)

• [...] que poderiam ser utilizadas em “atividades emocionalmente mais realizadoras”. (4.° parágrafo)

Nos dois trechos, utilizam-se as aspas, respectivamente - UNIFESP 2015

Língua Portuguesa - 2015Leia o texto para responder a questão.

Você conseguiria ficar 99 dias sem o Facebook?

Uma organização não-governamental holandesa está propondo um desafio que muitos poderão considerar impossível: ficar 99 dias sem dar nem uma “olhadinha” no Facebook. O objetivo é medir o grau de felicidade dos usuários longe da rede social.

O projeto também é uma resposta aos experimentos psicológicos realizados pelo próprio Facebook. A diferença neste caso é que o teste é completamente voluntário. Ironicamente, para poder participar, o usuário deve trocar a foto do perfil no Facebook e postar um contador na rede social.

Os pesquisadores irão avaliar o grau de satisfação e felicidade dos participantes no 33º dia, no 66º e no último dia da abstinência.

Os responsáveis apontam que os usuários do Facebook gastam em média 17 minutos por dia na rede social. Em 99 dias sem acesso, a soma média seria equivalente a mais de 28 horas, que poderiam ser utilizadas em “atividades emocionalmente mais realizadoras”.

(http://codigofonte.uol.com.br. Adaptado.)

• [...] ficar 99 dias sem dar nem uma “olhadinha” no Facebook. (1.° parágrafo)

• [...] que poderiam ser utilizadas em “atividades emocionalmente mais realizadoras”. (4.° parágrafo)

Examine as passagens do primeiro parágrafo do texto: - UNIFESP 2015

Língua Portuguesa - 2015Leia o texto para responder a questão.

Você conseguiria ficar 99 dias sem o Facebook?

Uma organização não-governamental holandesa está propondo um desafio que muitos poderão considerar impossível: ficar 99 dias sem dar nem uma “olhadinha” no Facebook. O objetivo é medir o grau de felicidade dos usuários longe da rede social.

O projeto também é uma resposta aos experimentos psicológicos realizados pelo próprio Facebook. A diferença neste caso é que o teste é completamente voluntário. Ironicamente, para poder participar, o usuário deve trocar a foto do perfil no Facebook e postar um contador na rede social.

Os pesquisadores irão avaliar o grau de satisfação e felicidade dos participantes no 33º dia, no 66º e no último dia da abstinência.

Os responsáveis apontam que os usuários do Facebook gastam em média 17 minutos por dia na rede social. Em 99 dias sem acesso, a soma média seria equivalente a mais de 28 horas, que poderiam ser utilizadas em “atividades emocionalmente mais realizadoras”.

(http://codigofonte.uol.com.br. Adaptado.)

Uma informação possível de se concluir da leitura do - UNIFESP 2015

Língua Portuguesa - 2015Leia o texto para responder a questão.

Você conseguiria ficar 99 dias sem o Facebook?

Uma organização não-governamental holandesa está propondo um desafio que muitos poderão considerar impossível: ficar 99 dias sem dar nem uma “olhadinha” no Facebook. O objetivo é medir o grau de felicidade dos usuários longe da rede social.

O projeto também é uma resposta aos experimentos psicológicos realizados pelo próprio Facebook. A diferença neste caso é que o teste é completamente voluntário. Ironicamente, para poder participar, o usuário deve trocar a foto do perfil no Facebook e postar um contador na rede social.

Os pesquisadores irão avaliar o grau de satisfação e felicidade dos participantes no 33º dia, no 66º e no último dia da abstinência.

Os responsáveis apontam que os usuários do Facebook gastam em média 17 minutos por dia na rede social. Em 99 dias sem acesso, a soma média seria equivalente a mais de 28 horas, que poderiam ser utilizadas em “atividades emocionalmente mais realizadoras”.

(http://codigofonte.uol.com.br. Adaptado.)

De acordo com os pressupostos da campanha holandesa, - UNIFESP 2015

Língua Portuguesa - 2015Leia o texto para responder a questão.

Você conseguiria ficar 99 dias sem o Facebook?

Uma organização não-governamental holandesa está propondo um desafio que muitos poderão considerar impossível: ficar 99 dias sem dar nem uma “olhadinha” no Facebook. O objetivo é medir o grau de felicidade dos usuários longe da rede social.

O projeto também é uma resposta aos experimentos psicológicos realizados pelo próprio Facebook. A diferença neste caso é que o teste é completamente voluntário. Ironicamente, para poder participar, o usuário deve trocar a foto do perfil no Facebook e postar um contador na rede social.

Os pesquisadores irão avaliar o grau de satisfação e felicidade dos participantes no 33º dia, no 66º e no último dia da abstinência.

Os responsáveis apontam que os usuários do Facebook gastam em média 17 minutos por dia na rede social. Em 99 dias sem acesso, a soma média seria equivalente a mais de 28 horas, que poderiam ser utilizadas em “atividades emocionalmente mais realizadoras”.

(http://codigofonte.uol.com.br. Adaptado.)

Ciência explica _________________________. Testes - UNIFESP 2015

Língua Portuguesa - 2015

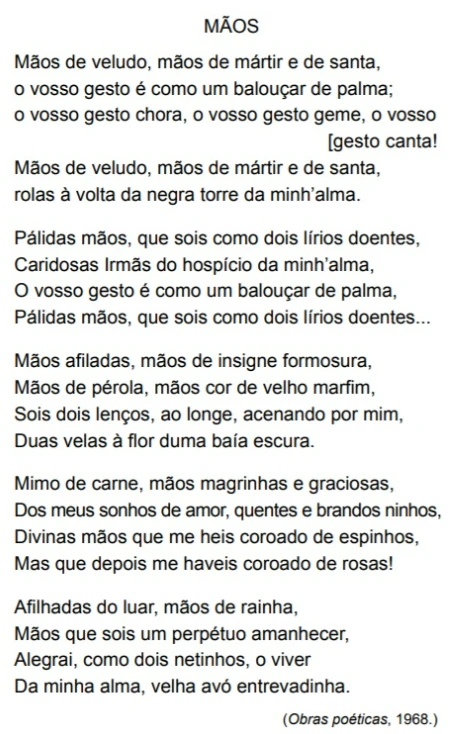

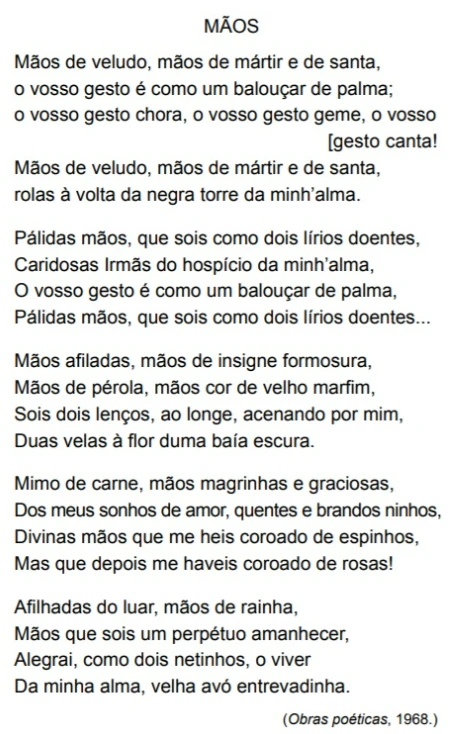

Assinale a alternativa em que a reescrita dos versos - UNIFESP 2015

Língua Portuguesa - 2015Leia o poema para responder a questão.

Mau Despertar

Saio do sono como

de uma batalha

travada em

lugar algum

Não sei na madrugada

se estou ferido

se o corpo

tenho

riscado

de hematomas

Zonzo lavo

na pia

os olhos donde

ainda escorre

uns restos de treva.

(Ferreira Gullar, Muitas vozes, 2013.)

Analisando-se as três estrofes do poema, atribui-se a - UNIFESP 2015

Língua Portuguesa - 2015Leia o poema para responder a questão.

Mau Despertar

Saio do sono como

de uma batalha

travada em

lugar algum

Não sei na madrugada

se estou ferido

se o corpo

tenho

riscado

de hematomas

Zonzo lavo

na pia

os olhos donde

ainda escorre

uns restos de treva.

(Ferreira Gullar, Muitas vozes, 2013.)

A leitura do poema permite inferir que a) o despertar - UNIFESP 2015

Língua Portuguesa - 2015Leia o poema para responder a questão.

Mau Despertar

Saio do sono como

de uma batalha

travada em

lugar algum

Não sei na madrugada

se estou ferido

se o corpo

tenho

riscado

de hematomas

Zonzo lavo

na pia

os olhos donde

ainda escorre

uns restos de treva.

(Ferreira Gullar, Muitas vozes, 2013.)

É preciso ler esse livro singular sem a obsessão de - UNIFESP 2015